Ontario Disability Support Program

Living with a disability can pose personal and emotional challenges. As well, there are often direct financial costs and economic challenges, both for the individual and surrounding family.

For Ontarians, the Ontario Disability Support Program (ODSP) is the anchor program assisting individuals and their families managing with disability needs. While it has many components, at its core ODSP delivers financial assistance for essential living expenses, provides a number of health care benefits, and offers help in finding employment and advancing a person’s career.

Here is an overview of the key features of ODSP.

Your rights and your responsibility

As an Ontarian 18 years or older with a disability, you have the right to apply for ODSP support. A caseworker reviewing your application is guided by policy directives intended to assure consistent service across the province, balanced with the discretion to cater to individual needs and circumstances.

At the same time, be aware that as a large public program, ODSP has plenty of administrative structure and financial oversight, with practical implications for the path that lies ahead for you. This includes detailed initial financial disclosure, regular caseworker reviews, and your continuing obligation to report and make first use of your own financial resources, supplemented by this public support program.

What is a “disability” for ODSP purposes?

The disability must be a substantial mental or physical impairment that is continuous or recurring, lasting for a year or longer. It has to be shown that it substantially affects your ability to work, to care for yourself or to participate in the community. This must be verified by a health care professional.

For those who meet the criteria for certain other government programs – the most familiar being the Canada Pension Plan (CPP) disability pension – no further medical evidence of disability is required. However, you must still apply and meet ODSP financial eligibility requirements in order to receive income support.

Two components of income support: Basic needs & shelter allowance

There are two core components of ODSP:

-

- Basic needs income support – To help cover food, clothing and necessary personal items

- Shelter allowance – To help cover rent/mortgage, utilities and other direct housing carrying costs

Note in both cases that it is “to help cover”, which is not an assurance of full coverage.

To show financial need, your household basic living expenses must be more than your income and assets. As ODSP income support is meant to supplement other income, you must seek out any financial resources you or your family may be entitled to receive. This is determined in consultation with a caseworker.

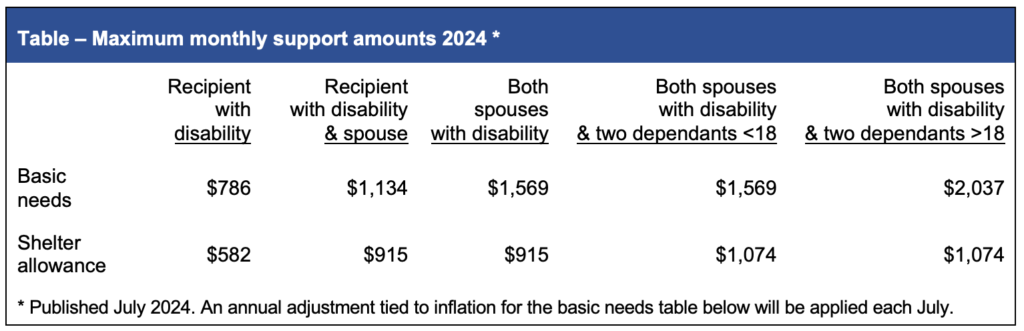

Once available resources are ascertained, attention turns to the number and age of those in the family, and whether your spouse has a disability. With so many variables, a full review is generally necessary to estimate the income support amount in a particular case. For general reference, the table on the following page shows the maximum support amounts available, using some examples of who might be in the household.

Working income affecting income support

You are entitled and encouraged to work. In fact, ODSP Employment Supports offers many resources to help with training, tools, assistive devices and even business start-up mentoring.

If you are indeed working, once your monthly income exceeds $200, 50% of your earnings is deducted from your income support payment. For this purpose, monthly earnings is the net you receive after mandatory payroll deductions like income tax, CPP and employment insurance premiums. The reduction may be offset by the $100 ‘Work-Related Benefit’ paid for each month you are working.

Treatment of income generally

Beyond employment, again all available income sources must be disclosed, including spousal support, business profits, Old Age Security, CPP benefits, and potentially even loans you receive. As with work income, these will reduce ODSP income support.

However, some sources are exempt from that reduction, such as child tax benefits, child support payments and amounts drawn from a registered disability savings plan (RDSP).

Receiving gifts

Each family member in the ODSP recipient’s household may receive up to $10,000 in gifts annually, with any excess treated as income. This dollar limit excludes gifts that go toward a disability related device or service, or into an exempt asset. (See “Asset limits” below.)

Health care benefits

Once you are entitled to income support, there are a number of health care benefits that come with that.

ODSP recipients are eligible for prescription drugs listed in the Ontario Drug Benefit Formulary. For adults there are basic dental services, and children under 18 are automatically enrolled in Healthy Smiles Ontario. If you don’t have eye care under the Ontario Health Insurance Plan (OHIP), ODSP covers routine eye examinations, major examinations for those with a medical condition or infection, and periodic eyeglass prescriptions and repairs.

Asset limits, and loss of income support

You will not be entitled to income support if the value of your assets exceeds a certain level. The limit is $40,000 for a single person or $50,000 for a couple, plus $500 for each dependant other than a spouse. This includes cash, banking and investment accounts, registered retirement savings plans (RRSPs) and tax-free saving accounts (TFSAs), secondary/rental properties and even valuable collectibles (eg., stamps, hockey cards).

Fortunately, there are many items that are exempt. This list includes the home you live in, personal clothing and furniture, your primary vehicle, and funds in registered education savings plans (RESPs) and RDSPs. Also excluded are amounts in life insurance cash values and trusts from gifts/inheritances, together totaling up to $100,000.

Preserving ODSP with a discretionary ‘Henson’ trust

That mentioned $100,000 limit for trust-held funds and insurance may not be adequate where there are significantly more assets that would otherwise be available to the ODSP recipient. In that case, in order to better preserve ODSP support, a more sophisticated trust arrangement might be considered.

A fully discretionary trust allows a trustee alone to decide the amount and timing of payments to a trust beneficiary who has a disability. Because the beneficiary has no legal right to force the trustee’s hand, ODSP does not include any such property in asset limits. This is commonly known as a “Henson trust” for the 1989 Ontario case that challenged the predecessor Ontario support program.

Even though the trust capital is not considered an asset for ODSP purposes, payments from the trust may be considered income that could affect ODSP support. Payments will generally be considered exempt as income, for example, if used for:

-

- approved disability related items, services, education or training expenses that are not reimbursable

- the purchase of a principal residence or an exempt vehicle;

- first and last month’s rent necessary to secure accommodation; or

- any purpose up to $10,000 maximum in a 12-month period.

The use of a trust in this way should not be taken lightly, as it places a very high degree of power and responsibility in the trustee. A qualified trust lawyer familiar with disability issues can advise on whether and how to proceed, taking a view of the totality of circumstances. For an in-depth discussion of this topic, please see the companion article Disability needs planning using trusts.