Tax-optimizing your philanthropy

When it comes to charitable donations, the most likely type of donation that comes to mind for most of is cash. However, there are a variety of ways to support your favourite charitable causes, one of which is to donate publicly traded securities in-kind.

The Canada Revenue Agency (CRA) defines a publicly traded security to include a share, debt obligation or right listed on a designated stock exchange, a share of the capital stock of a mutual fund corporation, a unit of a mutual fund trust, an interest in a related segregated fund trust or a prescribed debt obligation.

When such securities are donated in-kind from a non-registered account, a tax receipt is issued for their fair market value (FMV) on the donation date. As with cash donations, a tax credit can then be claimed to reduce your income tax bill. In addition, in-kind donations can cost you less, and there is no reduction in what the charity receives.

How the donation tax credit works

When you make charitable donations, both the federal and provincial governments allow you to claim a credit against the income tax you owe. The tax credit is based on the total dollar value of all donations in the year, no matter how many individual donations you make. The value of the credit varies by province, with the credit rate ranging from 20% to 25% on your first $200 of annual donations, and 40% to 54% on the amount over $200.

You can claim donations up to 75% of your net income in a year. Donations not claimed in the current year can be carried forward to be used in any of the next five years. This assures that a large single donation can be fully utilized, even if it exceeds the net income threshold. As well, this gives you flexibility if it is more beneficial to forego claiming the entire credit in the current year, and instead strategically spread it across multiple years.

For more on the principles of the donation tax credit, see the article Four tax strategies to get more bang for your charitable donation buck.

Donating cash or selling appreciated securities?

Most people make periodic charitable donations in cash, but that may not be optimal when you own securities that have appreciated in value. Cash is worth what you have in your hands, but appreciated securities carry a waiting tax bill. More specifically, in the 2024 Federal Budget the income inclusion rate for capital gains was increased to 2/3, but the prevailing 1/2 rate remains available for individuals on the first $250,000 of capital gains in any year. For trusts and corporations, the 2/3 rate applies to all capital gains. The 1/2 rate is used in the examples in this article.

Let’s say you want to contribute to a local charity’s capital fund, and you have equal balances in your chequing account and your (appreciated) securities account. If you write a cheque, you still have your securities, but with their pending tax liability. If you sell the securities to make the donation, there is less money available for the donation due to the tax, which means that either the charity gets less, or you need to top up the donation from your chequing account.

One way or another, you or the charity will bear the brunt of the tax in these two scenarios. The question is whether there is a way for you to keep your fully spendable chequing balance, while making the maximum donation to the charity using your securities? This is where in-kind donations come in.

Donating securities in-kind to eliminate tax on capital gains

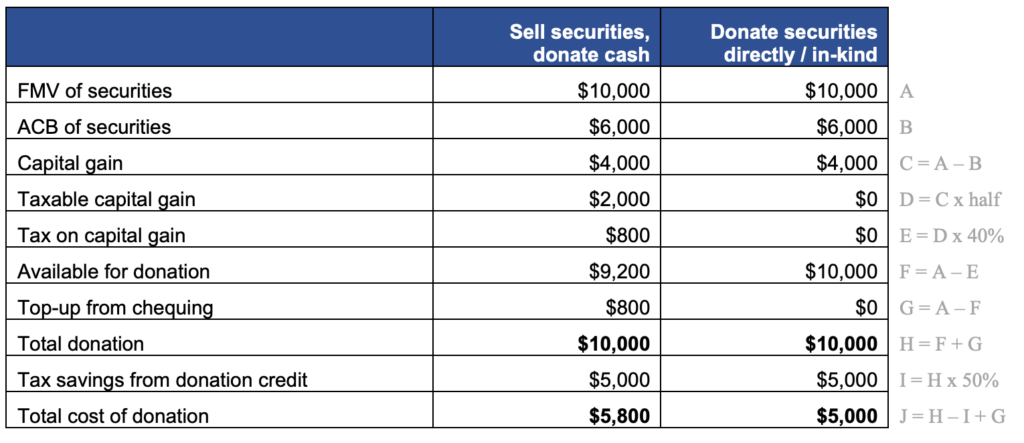

Typically, when there is a change of ownership of a security, a disposition is deemed to occur, and a capital gain or capital loss is triggered. However, when a security is transferred directly to a registered charity as a donation, the tax on any capital gain is reduced to zero. We can illustrate this with the following example:

-

- Donor is in a 40% combined federal-provincial tax bracket in a province with a top donation credit rate of 50%

- $10,000 donation, using a security with $10,000 FMV and $6,000 adjusted cost base (ACB)

- There has already been $200 in charitable donations made elsewhere this year

Donating securities in-kind to trigger a capital loss

The donation of appreciated securities is attractive, as we have just outlined. However, donating depreciated securities can also be a viable option, especially when it comes to your year-end tax planning.

When you donate depreciated securities, you trigger a capital loss that will be applied against capital gains realized in that same tax year. You can then carry back any remaining capital loss to offset capital gains in the three previous tax years or carry those losses forward indefinitely. So not only will you receive a tax credit for the FMV of the donated securities, you will also be reducing your tax bill if you have realized capital gains elsewhere.