Making the most of the donation credit

You support your favourite charitable causes because you care. Sometimes you share their message, sometimes you volunteer, and sometimes you donate.

While all those activities are positive contributions, you can also receive some favourable tax benefits. And for simplicity, we’ll assume a cash donation in our examples .

Don’t apologize for the tax break

Now, some people may think it’s distasteful to talk about tax breaks in the same breath as charitable giving. Shouldn’t it be about the caring, and not cashing-in?

True enough, caring about the cause must be at the core of your decision to donate. At the same time, if you have given out of a kind heart and are still entitled to a tax break, why would you not claim it? There are at least two ways to look at this:

-

- Using the tax break allows you to reduce your out-of-pocket cost to donate the same intended amount

- Understanding that the tax break is coming, you can share it with the charity by choosing to give even more

1. Basics of the donation tax credit

For starters, the government literally pays you back when you make charitable donations. It does so by giving you a tax credit that reduces your annual income tax bill.

Let’s say that you make a $100 donation, whether that’s to one charity or across a number of them. The federal government and the provincial government will each reduce what you would otherwise owe them. On average across the provinces, the credit rate is around 25%, so in this case your taxes are reduced by $25.

Put another way, it cost you $75 for the charity to have $100 to work with. Not a bad deal.

2. Breaking the $200 threshold

Okay, now we’re going to make you even more generous, and we’ll see how the tax system is generous back to you in return.

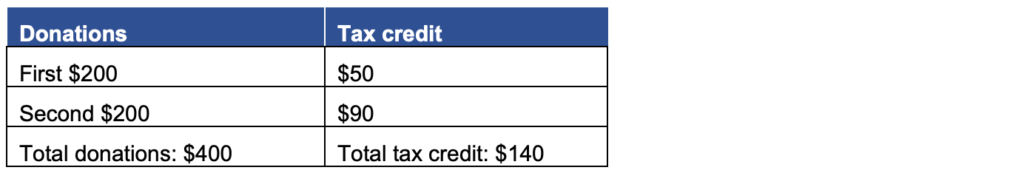

If you make donations over $200 in the year, on average across the provinces the tax credit is increased to around 45%. That’s almost half back from the tax collectors what you gave to the charity in the first place. In fact, in some provinces, the combined rate is actually 50%.

Keeping with the 45% average to illustrate, here’s what a $400 donation would look like:

In this case, it costs you $260 for the charity to receive $400. That’s a deal that continues to get better as you make even larger donations, with additional amounts entitled to the higher credit rate.

3. Combining with your spouse to accelerate into that top tier

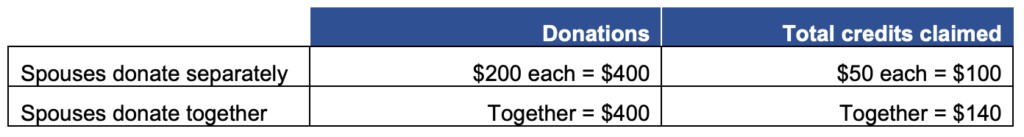

There is one simple way to get up to that higher credit rate faster, and that’s by combining donations in your household. Spouses are allowed to report their combined donations on one of their tax returns.

If two spouses had each made $200 in donations and separately claimed them, the total credit would have been $50 x 2 = $100. But as we saw in that last example, by claiming on one of their income tax returns they would receive a $140 credit, a 40% increase just for filing with this in mind.

4. Carrying forward, to obtain more of the high-rate tax credits

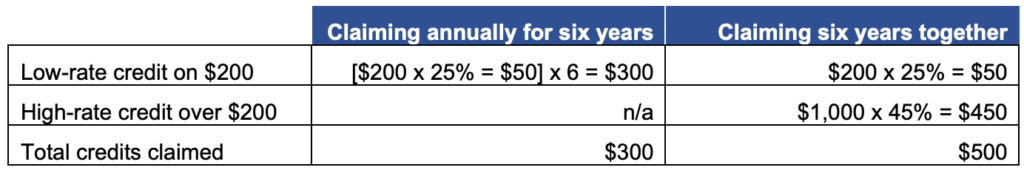

Whether or not you have a spouse, you can still be strategic in how you claim donations, by carrying donations forward up to five years to claim multiple years’ donations in a single year. Rather than facing the low credit rate on the first $200 each year, the low rate will only apply once this way.

Modifying our example, suppose that our couple consistently donates $200 annually. They decide to defer for the maximum five years on the earliest donation, so that six years’ donations are claimed at once. Either way, a total of $1,200 is given to charity.

In this example, that’s a whopping 67% increase in tax credits, though it comes at the expense of waiting up to six years to claim them. At this level of donations, it’s worth pooling up at least a couple or few years at a time, though maybe not to the extreme timeframe above. On the other hand, when annual donations are larger, the low rate on the first $200 becomes proportionately much less of a concern, so donating and claiming in the same year will likely make the best sense.

Charity first, tax in support

Once more, charitable giving is first and foremost about being charitable. But when you combine it with being tax savvy, you can make your money go further, whether you take that benefit yourself or you share it with the charity.