What happens when you are ready to draw down your RRSP?

A registered retirement savings plan (RRSP) allows you to deposit and accumulate tax-sheltered savings. Once you are ready to use those funds for your retirement, there are three options available – individually or in combination – for you to ‘mature’ your RRSP:

-

- Cash-in your RRSP — The entire cashed-in amount will be taxable that year, which could push you into higher tax brackets, so this is not usually desirable except to close out a small RRSP.

- Purchase an annuity — Annuities pay a guaranteed fixed amount for life or a set number of years. Payments are often made monthly, with the total annual receipts taxable each year.

- Transfer to registered retirement income fund (RRIF) — You must take a minimum amount out of a RRIF each year (except the first/transfer year), though you can take more. Amounts taken are taxable each year.

When can you start a RRIF?

You can start a RRIF at any age, not just when you are retired from working. Still, since the required withdrawals are taxable, you generally wouldn’t do so until you need the funds for living expenses – but you can’t wait forever. By the end of the year you turn 71, your RRSP must be matured by one or more of cashing-out, annuitizing or transferring to a RRIF.

Investing with continued tax sheltering

Unlike an RRSP, you cannot contribute anything more into a RRIF. To be clear though, you aren’t required to mature all your RRSPs at the same time. You may decide to keep some money in RRSP form, to be used to set up another RRIF (or annuity, or cash-out) at some time in the future, bearing in mind the age 71 outer limit.

Apart from what you take out of a RRIF, whatever remains within it will continue to grow tax-sheltered. As to investments, you are able to choose among essentially the same options available to you in your RRSP.

How are RRIF minimum annual withdrawals calculated?

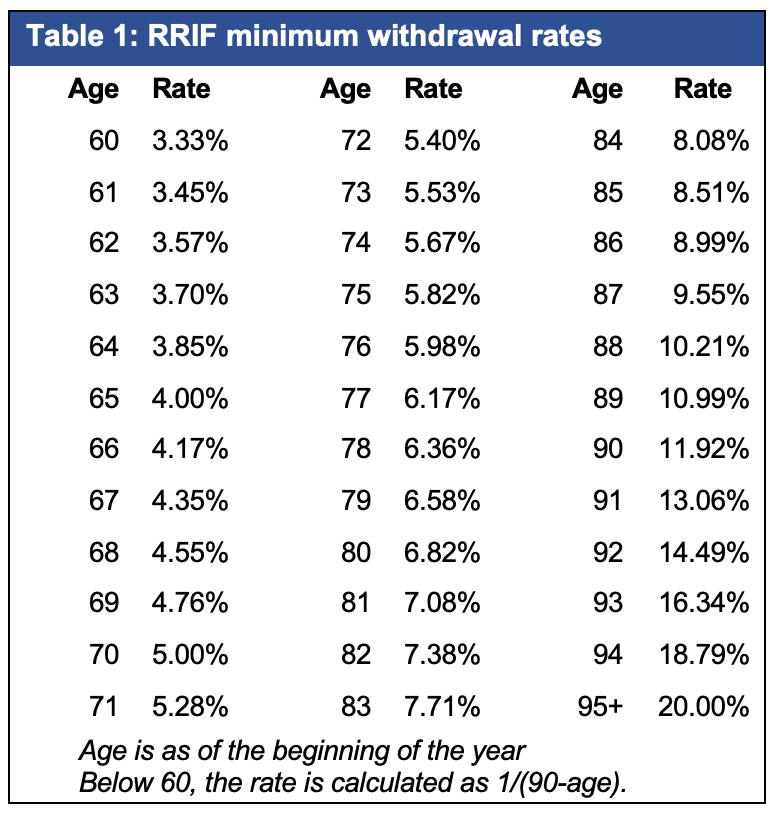

A minimum must come out of a RRIF each year, based on your age as the ‘annuitant’ at the beginning of the year. Minimum withdrawal rates are on Table 1 following. The shown rate at each age is multiplied by the RRIF value at the beginning of the year to obtain the required minimum withdrawal. Once again, there is no minimum the year the RRIF is set up.

If you wish, you may use the age of your spouse/common law partner (CLP) as annuitant, which would reduce the minimum if he/she is younger. If you do this, the payments are still made to you and taxed to you, even though the rate is based your spouse/CLP’s age. When you file your annual tax return, you may be able to elect for some of that RRIF income to be split with and taxed to your spouse/CLP, as discussed further below.

Withholding tax

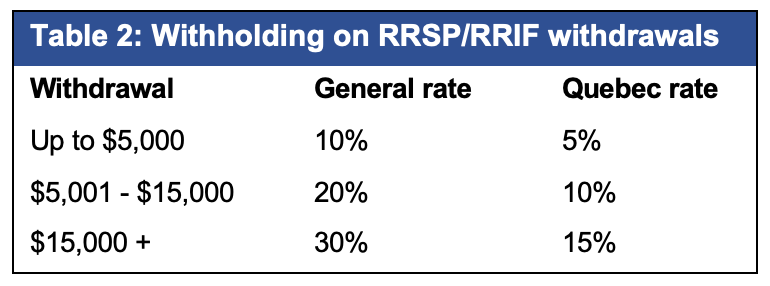

The RRIF administrator must withhold tax on withdrawals to remit to the Canada Revenue Agency (CRA), but only on any amounts over the minimum. See Table 2 below. Understand though that all RRIF withdrawals are taxable.

When you calculate your actual tax due on your income tax return, you receive a credit for the withheld taxes. This may lead to a tax refund if more was withheld than necessary, but if the withheld amount is insufficient then you will owe the difference.

Quarterly instalments

When you file your return, if the difference between tax payable and withheld tax is over $3,000 ($1,800 in Quebec) for the current year and either of the two preceding years, you may have to pay future taxes in quarterly instalments. This can happen for example if the RRIF is large, and the annuitant is taking only minimums without any withholding. CRA will send you an Instalment Notice if this is the case, outlining the payment due dates, amounts required and process for making payments.

Annual splitting, and transfers at death

If you are over 65, you are entitled to split up to 50% of RRIF income with a spouse/CLP, which could reduce your household tax bill if your spouse/CLP is at a lower tax bracket. You make the election on your annual tax return. Each year, you may choose to split whatever amount suits your needs, again up to the 50% maximum.

On death, the full RRIF amount is normally brought into a deceased person’s terminal year income (January 1st to date of death). However, a tax-deferred rollover is allowed to a spouse/CLP who is named as RRIF beneficiary or who is an estate beneficiary with a financial entitlement at least as much as the value of the RRIF. It is also possible to roll to a minor child or a financially dependent disabled adult child in qualified circumstances.