Given the events of the past year, it’s probably a question that comes up fairly often now for financial advisors, and there’s no simple answer. Whether your clients are asking you out of nervousness for their nest egg, their jobs or both, it’s an extremely topical issue.

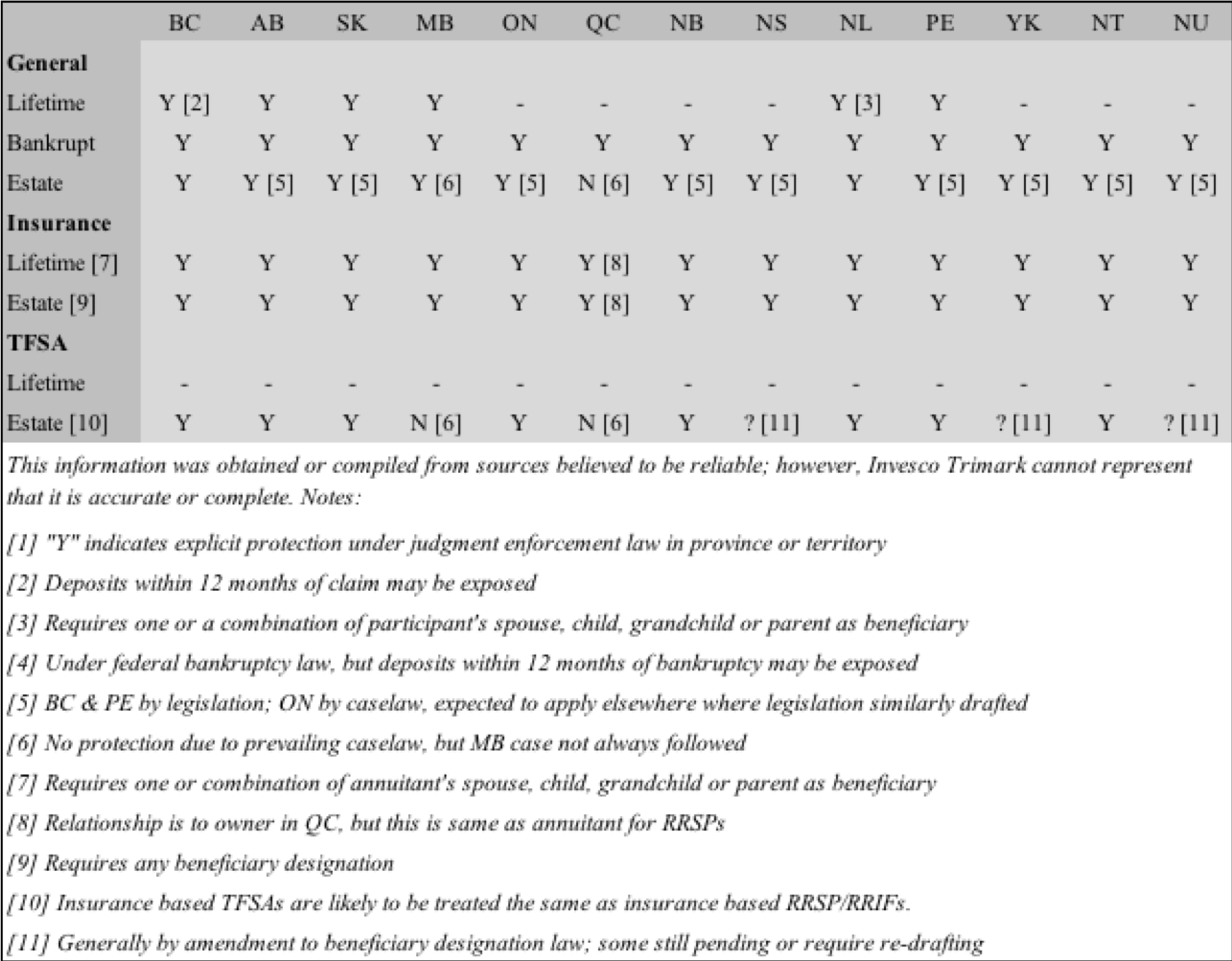

Last year’s amendments to the federal bankruptcy law gave RRSP/RRIFs a similar level of protection to their registered pension plan cousins. Short of bankruptcy, however, the question needs to be framed in terms of the type of plan being held, whether it is lifetime or estate protection at issue and concurrently what province or territory one resides in.

Expected creditor exposure

The chart below summarizes expected treatment.

Why is the creditor claiming?

Why is the creditor claiming?

Certain conditions and classes of creditors may override technical compliance with the rules, even for insurance-based plans. If a creditor can show a fraudulent conveyance or preference, impugned transactions may be reversible. It depends on the province or territory whether intent is a necessary component of the action, or if prejudice to the claimant is sufficient,.

It is also possible that matrimonial property, support orders and dependants’ relief claims could impress a trust upon RRSP/RRIF assets. As well, CRA has been successful in actions taken against registered plans.

Where any of these complications are present, legal advice should be sought out before making any moves.