Risk management for the entrepreneurial set

True entrepreneurs don’t take risk – they assess it, exploit it and overcome it.

That assessment process requires an understanding of market gaps so you can frame a vision for your business that capitalizes on those opportunities. It is then up to your entrepreneurial initiative to plan and deliver the business. But none of us are infallible or invincible.

Contemplating your limitations – and especially your own mortality – is a sensitive area emotionally. But not being informed can be far worse in reality.

That’s why life insurance is such an important tool: to preserve the business, which in turn protects the family it supports. Even more though, it rounds out your business planning by shining a light on latent risks, providing comfort to lenders to advance funds (with potentially improved terms), and offering tax advantages unlike any other financial tool.

Five fundamental questions in your insurance decision

Insurance is not a frequent conversation topic for most people. In its simplest elements, you pay premiums to an insurer, and it pays out the face value of the policy on a death. Premium payments are not generally tax-deductible, but proceeds are received tax-free.

Appreciating it in a business setting adds a layer or two of complexity. In addition to assuring that all risks are identified, you need to consider the cost-effectiveness of premium payments and the tax-efficiency of the proceeds payout.

At a minimum, five questions have to be addressed in any insurance discussion:

-

- What purpose does this insurance policy serve? In insurance-speak, the ‘risk’ is that a death occurs, and the ‘peril’ is that some economic damage will result. So, what damages are you protecting against?

- What duration is the insurance needed for? Put another way, at what point in time will there no longer be a peril/damage to be concerned with, or will it always be there?

- Who should own the insurance? This is who pays the premiums. In a personal situation, you may own on yourself, or spouses on each other, or parents on children – and there can be more variations. For a business, particularly when run through a corporation, there are at least as many considerations, including whether to own from within the business/corporation, or outside in personal hands.

- Who should receive the proceeds? In some cases the recipient may be the owner, while in others it may be one or more named beneficiaries. In a business situation (again where a corporation may be involved), there can be many steps involved, requiring coordination with other personal and business documents, including trusts, Wills, corporate resolutions and shareholder agreements.

- Finally, what amount of coverage is appropriate? This brings it full circle to the economic exchange you have with the insurer. Having asked and answered the preceding questions, you are now ready to turn to quantification, and affordability.

Four principal business purposes for insurance

Especially in a single-person operation, the overlap between personal and business needs can appear almost indistinguishable. Discerning the differences is critical to being able to make the best-informed decisions. Though not an exhaustive list, here are the most common situations for the use of life insurance in a business.

Buy-sell funding

A buy-sell agreement is only as good as the ability of the parties to carry it out. In the fullness of time, the expectation will be that each party will have the financial wherewithal to execute a buyout.

An early death can thwart that intention, potentially putting the business, the continuing owners, and the deceased’s family at risk. Insurance enables timely payout to the deceased’s survivors, and smooth continuity of the enterprise for the continuing owners.

In the case of a corporation, it is most prudently documented in a binding shareholders’ agreement – not just drafted, but executed.

Key person protection

Insurance can buy time for a business when someone critical to the operation is lost. It’s an injection of capital to help maintain the going concern value of the business on the loss of that key contributor.

Whether or not the deceased was an owner, the cash acts as a financial bridge until a suitable replacement can be found, or at least until operations can be stabilized.

It may also include an estimate of direct lost revenue and extraordinary expenses.

Estate tax liabilities

Tax on capital gains will arise when someone consciously disposes of capital property, or on a disposition that is deemed to have occurred in certain circumstances such as a person’s death. This applies to all business interests generally, though if the assets are qualifying small business corporation shares, the door is open to take advantage of the lifetime capital gains exemption, currently standing at $1,250,000 in 2024 (per the 20204 Budget), with indexing to re-commence in 2026.

If there remains tax liability on a capital disposition, it can be deferred if those assets are rolled to a surviving spouse. The deferral will carry through to when the spouse disposes of the assets, or on a deemed disposition on the spouse’s death. Either way, insurance still has a role to play, but now taking into consideration more participants in the arrangement.

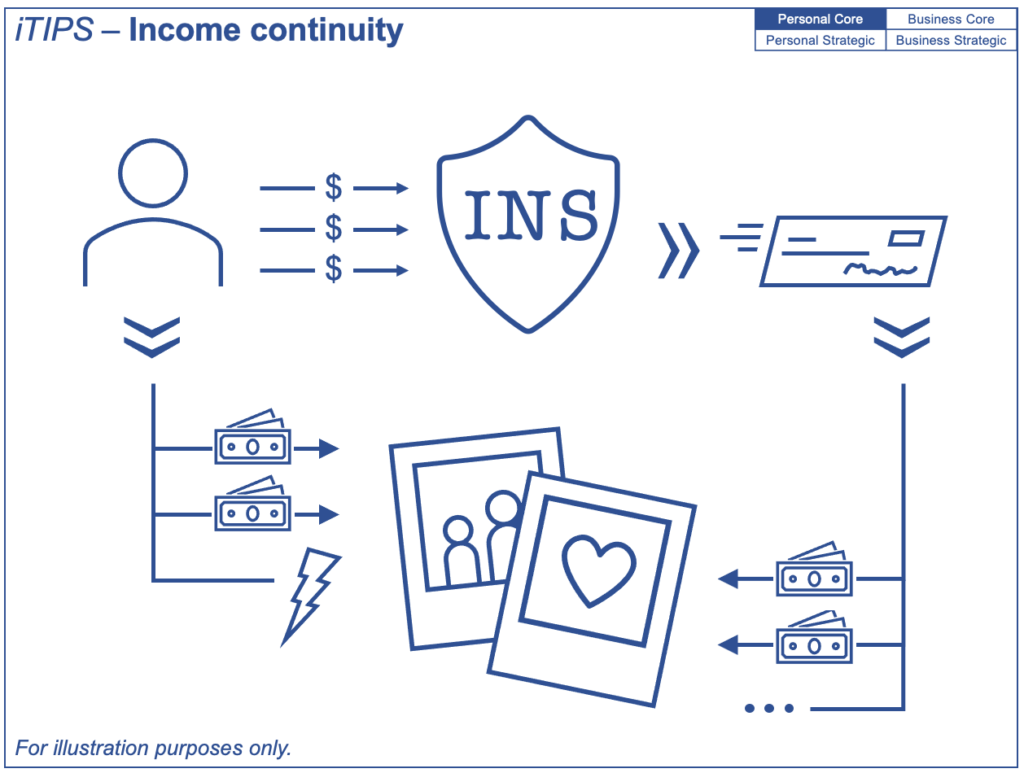

Income replacement

The most common use of life insurance is as a proxy for the lost income-earning capacity of a breadwinner to a household. The insurance proceeds fund a pool of wealth that can be drawn down over the time that the deceased would have otherwise contributed income. Though not physically present, the person is still there in financial spirit.

Seeing the purposes both together and apart

The first three of the foregoing purposes are clearly commercial in nature, whereas income replacement is a personal need irrespective of the existence of any business. Even so, it is not uncommon for a business owner – and particularly a shareholder running a corporation – to wish to combine multiple insurance needs into a single contract held in the corporation, or multiple policies some of which will be held at the corporate level.

This may make good sense for convenience as a gathering point and for cost-efficiency, but care must be taken to assure that the calculated amount for each respective purpose will make it into the hands of the appropriate recipient. This will often require the coordination of terms in shareholders’ agreements, Wills and corporate documents, so early involvement of legal counsel is a prudent approach.

Assuming this all passes muster, attention may turn to the tax implications of funding and receiving insurance through a corporation.

Use of a corporation, and life insurance within it

Except in very limited circumstances (none of which apply here), life insurance premiums are not tax-deductible for a corporation, no more than they would be for personally-owned life insurance.

However, corporately-paid premiums are nonetheless less costly than personally-paid premiums. The comparison is whether the corporation pays the premiums itself, or issues a dividend to the shareholder to pay the premiums personally. As the shareholder will be taxed on the dividend, less cash would be available for the purpose in those personal hands, thus requiring a larger dividend in order to net down to the required dollars for the premium cost.

On death of the life insured, the proceeds are received tax-free to the beneficiary, whether that beneficiary is a corporation or an individual. For a policy owned in a corporation, the corporation itself or a subsidiary corporation would be named as beneficiary; if not, the payment of the death benefit could give rise to a taxable shareholder benefit. (Similarly, a shareholder benefit would apply if a corporation pays the premium on a policy owned by a shareholder.)

Comforting though it is to know that a corporation receives insurance proceeds tax-free, even these business-based needs (except key person) still ultimately require the insurance proceeds to make it into personal hands to complete their intended purpose. Fortunately, there is a mechanism that allows for the transfer of tax-free amounts received at the corporate level to make their way into shareholder hands.

A corporation’s capital dividend account or CDA keeps track of items such as life insurance proceeds and the non-taxable portion of capital gains. Declared dividends to a shareholder will not be taxable if they are elected to come from the CDA. This election may also apply to deemed dividends that occur when shares are redeemed, for example when a surviving spouse decides to wind up the corporation after the death of a business owner spouse. Whether the full amount may come out tax-free depends on circumstances, but the bulk is usually treated this way. Again, informed legal and tax advice are a must, both at the time the insurance is established and when the payout happens.

Be aware that these are the fundamentals for understanding corporate ownership of life insurance. Things can get much more complicated in practice, which is why conscientious due diligence is critical – both in comprehending the technical issues, and in clearly understanding the needs of the business and the individuals behind it.