Aligning trust features with individual circumstances

Disability planning can be challenging to manage, even when focused on the health and medical issues alone. Extend that to navigating financial supports and tax benefits, and understandably it can feel overwhelming. Trusts1 can ease both the financial pressure and mental stress this can bring on, whether planning for oneself, a spouse2, a child, a sibling, or extended relations.

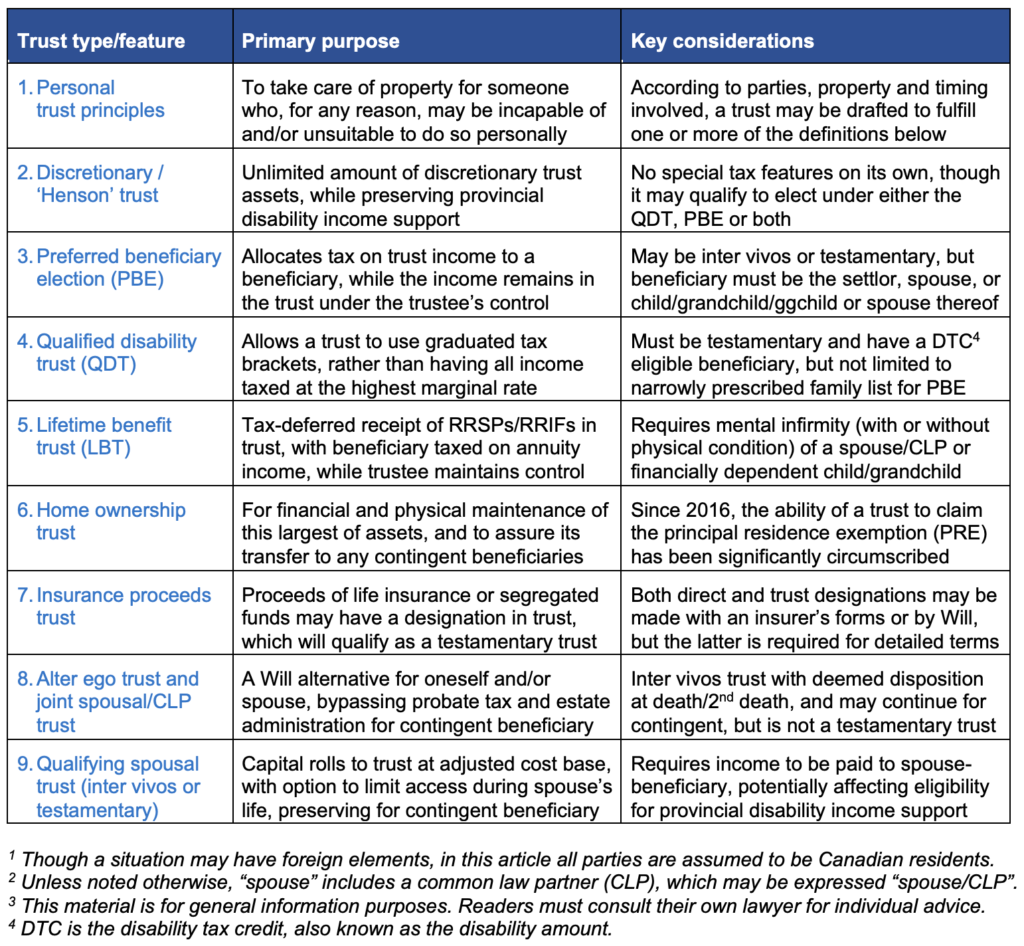

The table below highlights the type and features of trusts that can assist those with disabilities, with more detailed discussion in the following pages. In addition, for current tax and financial figures, please see the companion article Disability income support and tax benefits.3

1. Personal trust principles

At its core, a trust separates legal ownership of property from beneficial ownership. The original property owner (the settlor) wishes to provide for someone (the beneficiary) who may be incapable of, or unsuitable to be managing property personally. By creating/settling the trust, the settlor chooses a person (the trustee) whom the settlor trusts in both the generic sense of confidence and in the formal position of having legal control.

For the disability trust types and features discussed below, the drafting must adhere to the appropriate regulation or administrative guidance. Even so, there can be trade-offs among these options, so legal advice is a must.

2. Discretionary / ‘Henson’ trust

Provincial disability income support programs require that applicants provide initial and ongoing financial disclosure. The specifics vary by province, but generally these programs are intended as a safety net for vulnerable people who do not have, or have exhausted, personal resources in managing their lives. Thus, if an individual’s assets or annual income exceed prescribed figures, benefits may be reduced or eliminated altogether.

A discretionary trust can help shield against inclusion of some assets and income sources in this determination. This is sometimes called a ‘Henson’ trust, a reference to the 1980s Ontario case that ruled on the issue. Though technically only applicable to the Ontario program (now the Ontario Disability Support Plan, or ODSP), most provinces abide by similar principles, but with some variation so it is prudent to verify with provincial officials.

The defining (and really the only) feature is that the trustee has absolute discretion as to the amount and timing of trust distributions. As the beneficiary cannot compel payment, those assets will not be counted when determining eligibility or amount of support. Distributions to the beneficiary are subject to the program’s usual income rules.

Helpful as this can be, other factors aside from public support may influence when, how and even whether to use such a trust, depending on available assets and other income sources, and implications for access to tax benefits.

Ontario Inheritance trust

Up to $100,000 that is received as beneficiary of an estate or life insurance policy may be transferred into a non-discretionary trust. It is treated as income in the month received, but an exempt asset thereafter if transferred into trust within six months. Annual trust income does not affect ODSP if added to trust capital (up to the prescribed $100,000 level), but distributions to the beneficiary are subject to the program’s usual income rules.

Manitoba EIA trust

Manitoba has a “trust property exemption”, under its Employment and Income Assistance (EIA) Regulation. It allows up to $200,000 to be contributed to either/both an EIA trust and a registered disability savings plan (RDSP) without affecting support eligibility. Recent legislation passed in 2021 came in force in 2023, but the associated regulation did not come in force at the same time. Consult a Manitoba lawyer for current status.

RDSPs generally

A RDSP is not a personal trust, but as it was mentioned above in discussing Manitoba, it bears noting that all provinces exempt it as an asset. As well, distributions are treated as exempt income (partial in NB, PE and QC).

3. Preferred beneficiary election (PBE)

The preferred beneficiary election (PBE) allows for tax on income earned in a trust (inter vivos or testamentary) to be allocated to certain beneficiaries, while the income itself remains in the trust. The trust must have one or more preferred beneficiaries, and may also have other non-preferred beneficiaries. A preferred beneficiary is a person:

-

- Of any age who qualifies for the DTC, or

- Who is 18 or older, and a dependant of another individual due to mental or physical impairment, and whose annual income (not including any allocation under the PBE) is no more than the maximum basic personal tax credit amount

In addition, the beneficiary must be one of the following:

-

- Settlor of the trust

- Spouse/CLP or former spouse/CLP, of the settlor

- A child, grandchild, or great grandchild of the settlor, or

- Spouse/CLP of a child, grandchild, or great grandchild of the settlor

The trust will pay no tax up to the basic personal exemption and can apply graduated bracket rates above that. Despite using the beneficiary’s credits and brackets, the election does not affect provincial disability income support.

Legal requirement for a joint election

To obtain this treatment, the preferred beneficiary and the trust must make an annual joint election that is filed with the trust’s T3 Tax Return. If the beneficiary is legally incapable of making the election, it may be made by the person’s attorney for property if one was appointed before the beneficiary was found to be incapable, failing which it will be necessary to commence a court application to appoint a guardian of property for the beneficiary.

4. Qualified disability trust (QDT)

Since 2015, most testamentary trusts are taxed at the highest marginal tax rate in the province, as has long been the case for inter vivos trusts. However, if a testamentary trust has a ‘qualifying beneficiary’ (one who is eligible for the DTC), it may be able to use graduated tax brackets as a qualified disability trust (QDT).

Like the PBE, the trust and beneficiary must make an annual joint election, and if the beneficiary is incapable then an attorney or guardian for property may do so. Note that while a qualifying beneficiary can only make this election with one trust in a year, the trust may have other beneficiaries in addition to the qualifying beneficiary. Be aware that if a capital distribution is made to anyone other than the qualifying beneficiary, QDT status will be lost and the trust will be taxed at the highest bracket rate that year, with the added risk of reassessment of past years’ T3 returns.

There was initial concern when the QDT was introduced that use of the PBE may be limited thereafter, but either or both elections may be made in a year if the respective conditions of each provision are met.

5. Lifetime benefit trust

A person’s assets are deemed disposed on death, including causing the value of registered retirement savings plans (RRSPs) and registered retirement income funds (RRIFs) to be taxed in the deceased’s final year. This inclusion can be deferred to a spouse/CLP or financially dependent child/grandchild who is a plan beneficiary. However, if that person has a disability, concerns may arise as to how the money might be managed after receipt.

With this in mind, the RRSP/RRIF holder could instead direct the proceeds to a lifetime benefit trust (LBT), of which the intended recipient is the lifetime beneficiary. Preferably this will be done using a Will, so the trustee can be given detailed instructions, as needed. Whether designated on a plan or by Will, this is only available for mental infirmity, not for strictly physical conditions. On the other hand, the condition need not be so severe that the person qualifies for the DTC, though if the DTC is being claimed then that can bolster the assertion of mental infirmity.

There is no tax when the LBT receives the RRSP/RRIF. The trustee must use those funds to acquire a qualifying trust annuity (QTA), which will make periodic payments to the LBT. By default, the trust is taxed at top bracket, but the annual annuity income may be attributed to the beneficiary, to make optimal use of tax credits and graduated brackets. The trust then pays the beneficiary’s tax, and the net income remains under the trustee’s control.

The trustee must use the trust money for the comfort, care and maintenance of the beneficiary, who has a lifetime interest. This is to distinguish from any contingent beneficiary/ies the RRSP/RRIF holder has designated to receive any undistributed balance in the LBT and any commuted value of the QTA upon death of the lifetime beneficiary. This provides comfort and certainty that the remainder cannot be redirected by the lifetime beneficiary’s Will (or by intestacy in the absence of a Will), and that it will also bypass any probate tax.

Despite attribution to the lifetime beneficiary, the annuity payments to the LBT will not be considered the beneficiary’s own income, and so will not affect provincial disability income support. However, distributions from the LBT to the beneficiary may affect the amount of those benefits, subject to the program’s usual income rules.

6. Home ownership trust

Apart from assuring sufficient financial support for living needs, top priorities for the parent of a disabled child are a caring social network and a stable home environment. Indeed, the two go hand-in-hand, with the parent being the main provider. But as a parent ages, this becomes increasingly difficult to handle, and there can be even greater uncertainty after the parent’s death, even with diligent planning.

For the range of reasons already outlined, it may not be practical or desirable for a disabled person to directly own the home they live in. Consider further that a parent with other children will likely want to share his/her estate among them, even if a larger share may be earmarked for the child with a disability. This presents an especially large obstacle when the home (or the money needed for its purchase) constitutes the bulk of the expected estate.

So, whether it’s an only child or one of many, a trust may be a prudent alternative for home ownership. It could be an inter vivos trust created while the parent is alive and continuing after death (see Alter ego and joint spousal/CLP trust below), or a property owned by the parent at death could pass through the Will to a testamentary trust.

Principal residence exemption (PRE)

Without getting into all the criteria for the PRE, it generally protects against taxation of capital gains on disposition of a residence that a person owns and ordinarily inhabits. This can include a trust owning a residence inhabited by a beneficiary, though the availability of the PRE to trusts has been significantly circumscribed since 2016, now limited to the following trusts:

-

- A qualifying spousal/CLP trust, alter ego trust or joint spousal/CLP trust

- An ‘orphan trust’, being for a minor child of a deceased parent, or

- A qualified disability trust (QDT), but only if the trust was settled by a parent or spouse

If there are multiple beneficiaries of a QDT, and the trust claims the PRE on behalf of the DTC-qualified beneficiary in a year, this can affect future PRE claims of other beneficiaries on properties owned during overlapping years.

7. Insurance proceeds trust

For a parent preparing for what will happen after their own death, insurance and/or segregated funds may be intended as a principal source to provide for a child (minor or adult) with disability needs.

Generally, beneficiaries may be designated by an insurer’s forms, or by making a written declaration, including by Will. The declaration must comply with, and explicitly refer to, the relevant provincial Insurance Act provision to assure that the policy/plan proceeds do not form part of the estate for creditor or probate purposes. (This should be verified with a local lawyer, particularly in Saskatchewan where some courts have held otherwise on certain facts.)

If the beneficiary is a minor or is otherwise unable to give legal consent, the proceeds must be paid to a trustee for the beneficiary. As with a direct designation, a trust designation may be made by way of the insurer’s forms or by written declaration, again including a Will. Either way, it will be considered a testamentary trust for tax purposes.

Insurers will generally only allow brief terms for trust designations, whereas a Will may contain as much detail as desired. As will be evident from the foregoing discussion, a clear identification of powers and rights is critical to be able to make use of desired trust types and features. To achieve this, a properly drafted Will is recommended.

8. Alter ego trust and joint spousal/CLP trust

A person who is at least 65 can settle an alter ego trust of which he/she is the beneficiary, or joint spousal/CLP trust where both spouse/CLPs are beneficiaries. In the latter case, one or both may be settlors. Property is transferred into the trust tax-deferred at adjusted cost base (ACB), and future trust income is attributed to the settlor. Only the settlor or spouse may receive the income or capital of the trust while they are living, and contingent beneficiaries may be named to receive the remainder on death for an alter ego trust, or on 2nd death for joint spousal/CLP trust.

The main purpose of such trusts is as a Will alternative, as the contingent beneficiary designation allows for the bypass of any probate tax, and streamlines distribution outside of the formal estate. They may also be used with knowledge or anticipation of the settlor or spouse/CLP’s future disability or incapacity.

For parents of a disabled child, the contingent beneficiary designation may be part of the plan to provide for that child after the 2ndparent’s death. In deciding whether, when and how much to settle into such a trust, parents should be cognizant that this an inter vivos trust, so will not meet the requirements of a QDT which is required to be testamentary, but may qualify for the PBE.

9. Qualifying spousal/CLP trust (inter vivos or testamentary)

Like an alter ego trust or joint spousal/CLP trust, property can roll into a qualifying spousal/CLP trust at ACB, but in this case the spouse/CLP is the only beneficiary. Only that spouse/CLP may obtain the income (though taxation may be attributed to the settlor) or capital of the trust during his/her lifetime, and contingent beneficiaries may be named to receive the remainder at death.

Though this type of trust can be created inter vivos (at any age), it is more commonly established in a deceased’s Will to create a testamentary trust that provides for a surviving spouse/CLP. The ACB rollover in this case defers the tax that would otherwise apply due to the deemed disposition on death. There are a range of reasons for creating such a trust rather than making an outright transfer to the spouse as an estate beneficiary (which may also be by ACB rollover). For example, this may be useful in a second marriage situation, allowing continued use of assets by a surviving spouse/CLP, with ultimate distribution of capital going to children of a first marriage.

When testamentary, this trust may be an effective tool to care for a disabled surviving spouse/CLP, and after that person’s death to be part of the support for a disabled child. For either of those beneficiaries, it can qualify for the QDT and PBE, and may also be able to serve as a house ownership trust, including the ability to claim the PRE.