The compounding frequency of annual increases

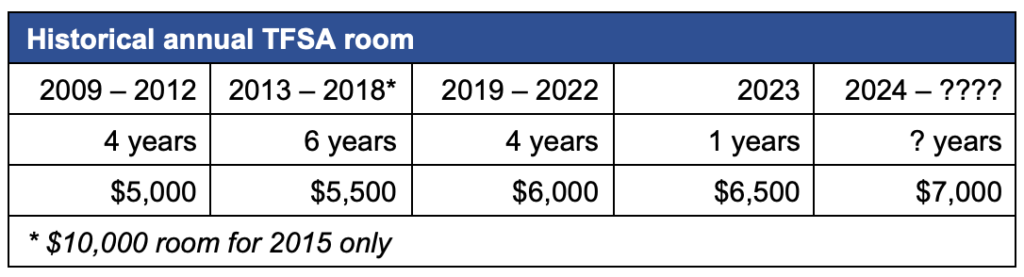

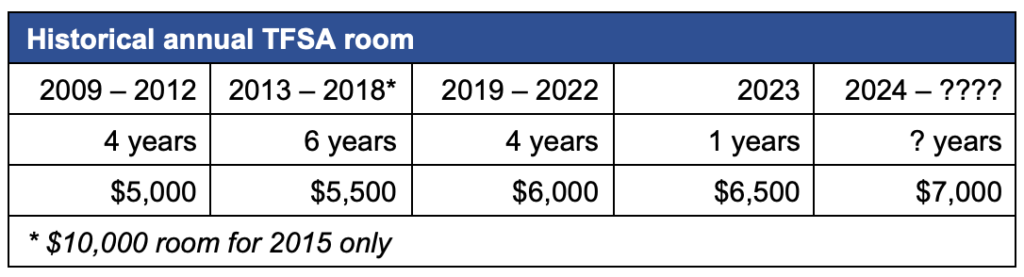

Since inception in 2009, the TFSA has had annual room increases about every five years – that is until the back-to-back bumps in 2023 and 2024 that brought the annual allotment up to its current $7,000 figure.

The annual room of $6,000 in 2022 would have elevated to $6,500 in 2023 with as little as a 1.5% rise in the consumer price index (CPI). As it turned out, 2022’s high inflation pushed the indexation factor to over 6.3%, contrasting sharply with the sub-2% annual average for the preceding 15 years since the TFSA was launched. That was followed up with a 4.7% CPI for 2023, helping explain why we saw increases in two consecutive years.

This is more than just a walk down economic memory lane. The way that the indexing formula is structured, it’s arithmetically inevitable that we’ll see more frequent annual increases in TFSA room as the years roll forward.

The TFSA indexing formula

One of the distinguishing features of the TFSA is how it is designed to keep up with inflation. Like many other elements of our tax system, it makes use of an indexing formula, but one that operates unlike those others in that changes in annual TFSA room don’t necessarily happen annually.

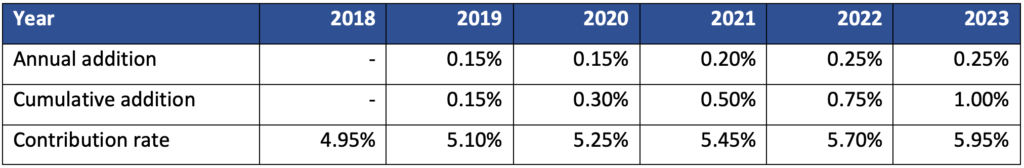

The indexation factor is in section 117 of the Income Tax Act. For a coming year, it is the average of the CPI for the 12-month period that ended on September 30 of the current year, divided by the average of the CPI for the 12-month period that ended on September 30 of the preceding year.

For things like income tax brackets and RRSP room, that factor applies directly to increase the respective element every year. The same indexation factor is used for the TFSA, but it’s an indirect calculation, such that changes to TFSA room only occur every few years. The factor augments a background reference figure, and only once that figure rounds to the next $500 level does actual TFSA room rise by that amount.

Bear in mind that the first move required just a half-step of $250 for the reference figure to cross $5,250 and force the round-up to $5,500. After that (and leaving aside the one-time doubling to $10,000 in the 2015 election year), the $500 increment was applied two more times to take us from the original $5,000 room in 2009 to $6,500 in 2023. Again, that’s about five years on average, before this one-year quick step in 2024 to $7,000.

A beneficial byproduct of this two-stage process is that TFSA room is always a round figure. While being careful not to overstate the case, this simpler expression may make TFSAs more understandable and accessible for those who may feel intimidated by tax minutia.

Frequency of future increases

Now consider that at the beginning, that $500 increment was 10% of the original $5,000 room. That same $500 is now just 7.1% of the current $7,000 room. With an ever-higher base upon which to apply the indexation factor, the number of years required to reach future levels will continue to compress.

We can observe this with an example that applies a consistent 2% indexation factor, which would match the Bank of Canada’s (BOC) long-term inflation target. Assuming a current reference figure of $6,861 in 2024 (an unofficial approximation based on the CPI rates since 2009), it will take four years to step up to $7,500, and just three years to hit $8,000, with continuing narrowing in following years.

On the other hand, if the recent high CPI foretells a period of sustained higher inflation (hopefully not!), then those jumps could be compressed even further. By my calculation, if CPI hovers around 3% (the high end of the BOC inflation target range), we could soon see TFSA room increasing every other year. As appealing as that may sound for the TFSA, it would be exceedingly disruptive to living expenses, meaning less cash available to take advantage of that increased room.

Accumulated unused room

Though the original $5,000 of annual TFSA room may have seemed modest when the program launched, there is now momentum to its indexed increases. And with the benefit of unlimited carryforward of unused room, the TFSA is likely to become an even more prominent financial tool for many people.

In fact, another way to look at indexing is to consider how the addition of room each year effectively indexes accumulated unused TFSA room. With the $7,000 of annual room credited for 2024, accumulated unused room stands at $95,000. For someone who has not yet taken advantage of their TFSA capacity, that’s an 8% increase to their waiting tax sheltering room.

One cohort for whom this could be especially apropos is couples who were early homeowners when the TFSA was introduced. Mortgage payments will have dominated their monthly budgeting in the intervening years, but now they’re likely seeing light at the end of that tunnel. Through accelerated bi-weekly payments they will have been able to reduce the amortization of a 25-year mortgage by almost eight years. Give it a couple more years and that extra household cash flow will align nicely with the combined $200,000+ TFSA room waiting to be exploited.