Rules in the Income Tax Act (Canada) governing trusts enable beneficiaries under a Will to receive their entitlements in a tax-advantaged manner.

For financial advisors – apart from enhancing after-tax investment returns – trusts can be an effective means for bridging over to the next generation of clients.

This month’s column reviews the nature of trusts, variations for using them to reduce taxes and some of the key creation criteria to be aware of.

Key elements of trusts

A trust is a taxable entity but it is not a legal entity. Rather, a trust is a property relationship among three elements:

Settlor – The original property owner who creates the trust

Trustee – The new legal owner and manager of the trust property

Beneficiary – The new beneficial owner for whom the property is managed

While there can be only one settlor, there is no limit on the number of beneficiaries. Likewise, there is no limit on the number of trustees, though for practical reasons one trustee is usually sufficient, with perhaps two or three named in complex situations requiring specialized skills.

Why use trusts?

Property may be placed in trust for a number of reasons, including:

Protective care

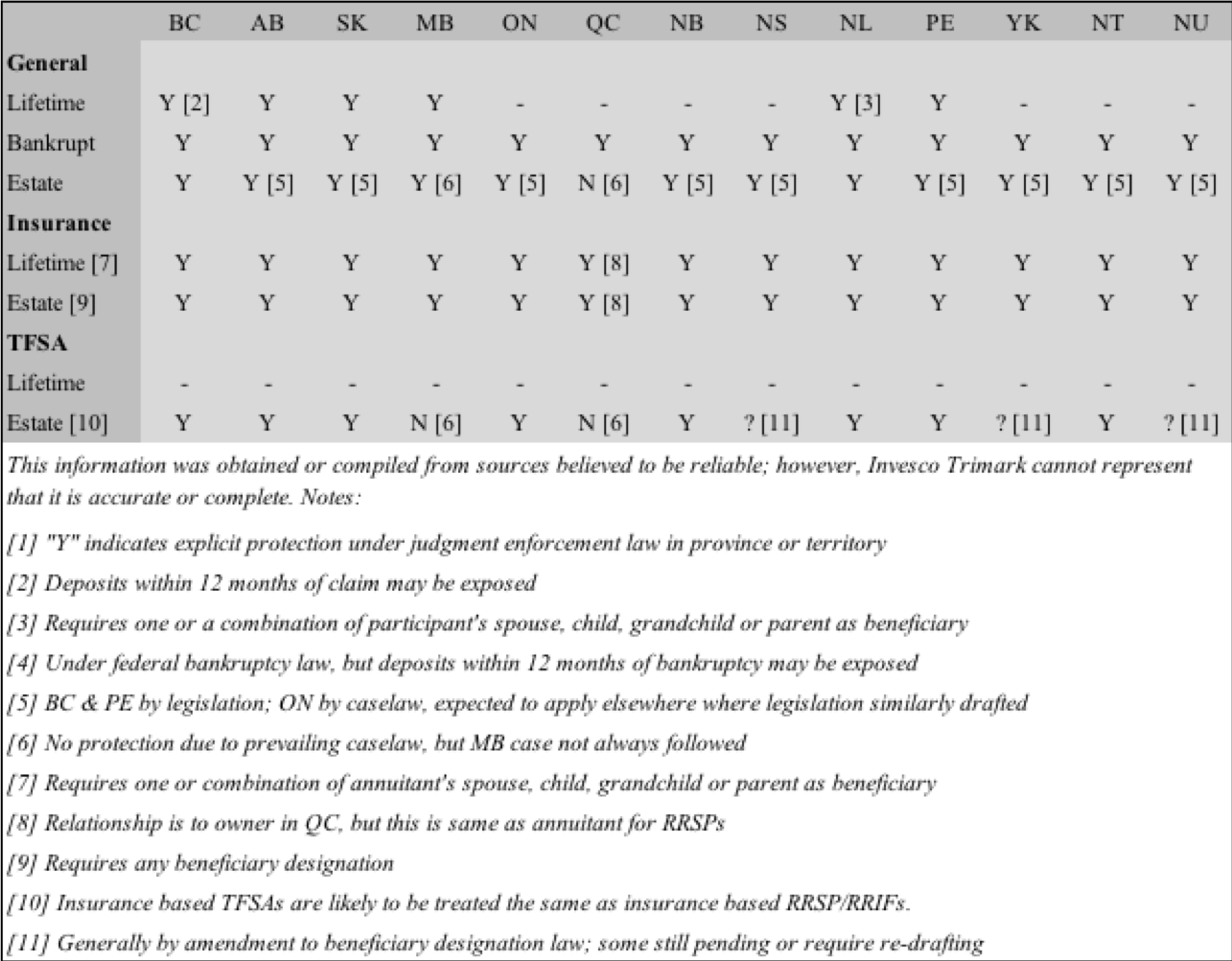

Creditor protection

Business planning, and

Tax advantage, particularly in managing an estate

Tax advantages of testamentary trusts

One of the main distinctions among trusts is between those created during a person’s lifetime (inter vivos trusts) and those created at death (testamentary trusts). There are little or no tax benefits to using inter vivos trusts.

All trusts are separate taxpayers from their beneficiaries. This separation can be particularly valuable for testamentary trusts as they are entitled to marginal tax bracket treatment similar to individuals, though they cannot claim personal tax credits available only to natural persons.

As an example, if a beneficiary in the top tax bracket receives an inheritance directly, almost half the related income will be lost to taxes. By comparison, a testamentary trust set up for that beneficiary will pay less tax on every dollar earned up to the top bracket level, currently at $126,264 in 2009. Even at more modest levels, if the combined income of the trust and beneficiaries exceeds even the lowest tax bracket threshold, the door is open for an opportunity to save taxes.

Tax-cutting strategies

Income splitting – The main strategy is effected by the settling of the trust itself, with the creation of a new taxpayer being the trust.

Spousal trusts – Tax-free spousal rollovers of capital property can be extended to one or more spousal trusts.

Income sprinkling – Selective distribution of trust income among beneficiaries can reduce the total tax bill for all beneficiaries.

Multiple trusts – The testator can create at least as many trusts as there are beneficiaries – more if life insurance is in place.

Long-term tax savings – Trusts can be effective tax-management vehicles for up to 21 years or more.

Obtaining the benefits

While a formal written trust document is not needed in all cases, to obtain the most desirable tax benefits, a well-considered estate planning process and clearly drafted Will are essential.

ED: Significant changes to trust taxation occurred in 2015, eliminating many of the tax-reduction benefits discussed here.