How to use trusts in estate planning

We say the word ‘trust’ regularly in our day-to-day language. When it comes to its legal use in estate planning however, the trust is likely a mystery to most people.

For centuries, trusts have been used to control, preserve and transfer property. While they may have been used more often by the affluent in the past, today the topic of trusts should be discussed in all estate planning conversations.

What they are is a form of property ownership. Even more important is what they do, which is to allow for that ownership to be carefully catered to individual needs – by breaking the ownership apart.

What is a trust?

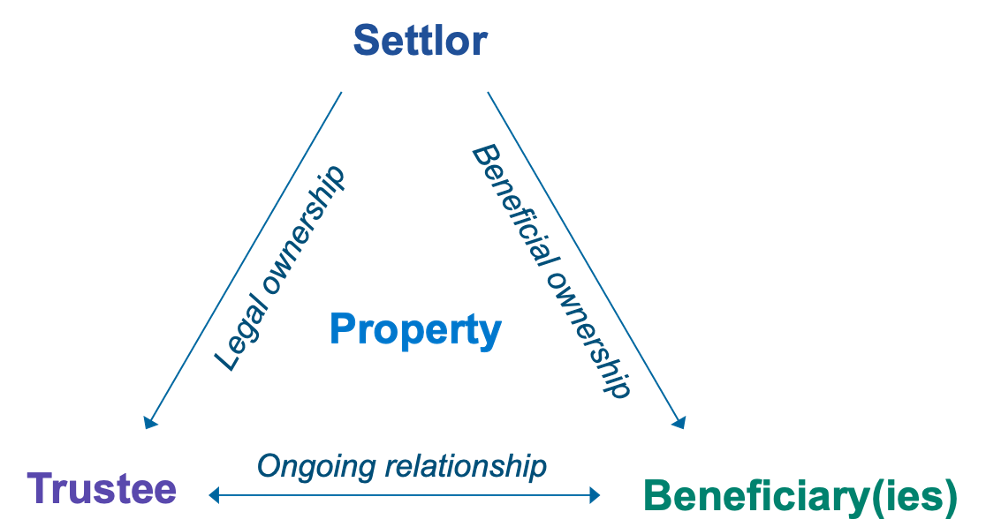

A trust is a way of separating legal ownership of property from the beneficial entitlement to that property. The legal owner holds the title, controls and manages the property, while beneficial ownership refers to the use, enjoyment, income and growth of the property.

The base structure of a trust is easily represented in the familiar shape of a triangle. The initial property owner, the settlor, names a trustee as the new legal owner of the property, who holds onto and manages it with the obligation to do so in the best interests of the beneficiary. This is called ‘settling’ a trust.

Commonly there is just one settlor, but it’s not unusual to have 2 or 3 trustees, and as many beneficiaries as circumstances require. In some situations, the settlor may also be a trustee, a beneficiary or all three.

In summary, a trust is the description of a property relationship. Specifically, it is not a legal entity, but it is however a taxable entity, and it is the trustee (as legal owner of the property) who is obligated to file tax returns on behalf of the trust.

Why would you want one?

A trust may be used when someone cannot or should not come into full ownership of property. With a trustee as legal owner, the property will still be available to the beneficiary, however it will be subject to instructions you give the trustee. Common uses include:

-

- Overseeing the inheritance of a minor child who can’t legally own property

- Insulating against creditors who may otherwise seize the person’s directly-owned property

- Preserving family wealth from claims arising on a marital breakdown

- Optimizing public support for a disabled person who may be subject to asset or income limits

- Keeping someone with an addiction from wasting their possessions

- Managing and monitoring charitable gifts

- Staging the distribution of inheritances down generations, or across blended families

- Tax planning between spouses, as well as for succession of businesses

Beneficiary breakdowns

Sometimes a trust has one beneficiary who has all beneficial rights to the property. Alternatively, just as there are many situations where a trust may be used, there are many ways that beneficiary rights may be broken down.

For example, under a Will you may be a primary beneficiary, or it may be contingent on someone else like a parent having predeceased. You could be entitled to a specific item, a set dollar figure or the residue that is left over. Your rights may immediately vest or may be deferred to a certain date or until some event occurs. If there are investments or real estate, you may get the income, the capital when it’s sold, or both. As well, that income may continue for a set period of time, up to a set amount, or for life.

How is one created?

Now that you have an idea of the ‘what, who and why’ of a trust, let’s look at the legal requirements for how one comes into being. These are called the ‘three certainties’:

-

- Subject matter: Can you identify the property that is to be held in trust? (either by directly naming or listing the property – or by providing instructions on how this will be done in the future)

- Objects: Are the beneficiaries known, or is there a way to conclusively determine who they will be?

- Intention: Is it clear that the settlor wanted to separate legal ownership from beneficial ownership?

A trust can be oral, written or both, but these certainties are clearest where there is a single written trust document. If the trust is created while you are alive, also called an inter vivos trust, the technical name of this document is an ‘indenture’. Alternatively, your Will passes your property at death to your executor as trustee of your estate. In this case we call you a testator, not a settlor, but your estate is a trust all the same.

Navigating taxes

Until 2015, trusts created by a Will, called testamentary trusts, were commonly drafted into Wills for the purpose of tax planning. Until that time, testamentary trusts were taxed at graduated bracket rates that progress from low to high income, similar to individual tax treatment. Now, they are taxed at top bracket, just like inter vivos trusts, those created during your lifetime.

Graduated treatment is however still allowed for the first three years of an estate (called a “graduated rate estate”) and for testamentary trusts for a beneficiary who qualifies as disabled under the tax rules. Trusts can also still be used in a variety of ways to defer taxes when transferring property between spouses.

Lastly, business succession planning is often driven by tax issues. In such cases, trusts don’t provide a direct tax benefit, but instead have the primary purpose of maintaining control without interfering with the tax planning.

Historically, a trust was not required to file a tax return if it had nominal income, had no tax due and had not disposed of capital property. As of 2023, all trusts (with limited exceptions) must now file an annual T3 Return, and include with it a Schedule 15 Beneficial Ownership Information of a Trust. These obligations now apply to bare trusts (where the trustee cannot act without instruction/permission of the beneficiary/ies), though bare trusts are exempt from the filing requirements for the 2023 tax year, unless CRA makes a direct request to a taxpayer. Further guidance from CRA is expected with respect to filing obligations in years after 2023.

Choosing a trustee

Fundamentally a trustee’s role is to own and manage property. For a professional trustee, that’s the business proposition being offered.

If instead a family member or friend is contemplated as trustee, their qualifications should also be evaluated. This includes organizational skills, financial experience and diplomatic aptitude, as well as the person’s age in relation to the expected time that the trust will continue.

Finally, as noted earlier, the trustee is required to always act in the best interests of the beneficiaries. This is known as a fiduciary, requiring both integrity and conscientiousness to steer clear of conflicts of interest. Put another way, it is critically important that the trustee be trustworthy, in the everyday sense of the word.