Informed use of employment insurance with a new child on the way

The decision to have children is as personal as it gets. But as impersonal as it may sound, one of the first considerations in deciding on a family expansion, is determining its impact on family finances. This means not just being ready to bear the cost, but also the potential reduced income.

At least at the start, the EI system offers some help to new parents.

Managing your expectations – Not full income replacement

Any way around it, you will be receiving less if you are not working. The general rule of EI is that is designed to replace 55% of your average weekly earnings, up to the maximum yearly insurable amount, which is presently $63,200 in 2024. That equates to a maximum of $668 per week, or less if your own income is less than that prescribed maximum. Either way, just like employment income itself, EI payments are taxable.

The general qualification requirement is that you need 600 hours of insurable employment in the 52 weeks preceding the claim. This criterion also applies to those applying for maternity and parental benefits (discussed below), in addition to showing that your regular weekly earnings from work have decreased by more than 40% for at least one week.

Types of benefits

Maternity benefits – For the expecting mother

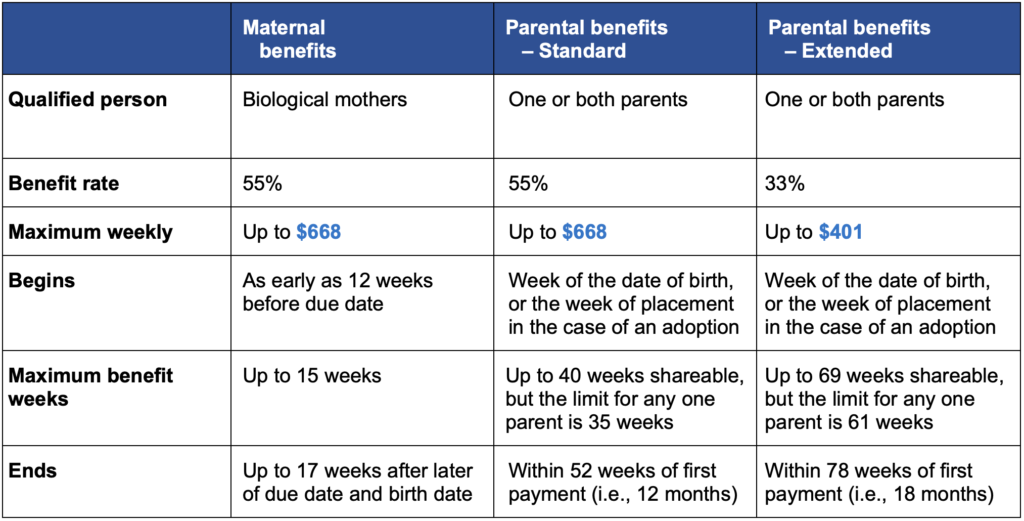

This is for biological mothers, including surrogate mothers who are away from work due to pregnancy or a recent birth. It runs for up to 15 weeks, beginning as early as 12 weeks before the expected date, and may continue as far as 17 weeks after the due date or the date of birth, whichever is later.

As with general EI, it applies at a 55% benefit replacement rate, again up to the current prescribed dollar maximum (indexed annually) per week for the benefit period.

Parental benefits – Relief time that can be shared by two parents

Parental benefits are available to one or both parents of a newborn or newly adopted child. Both parents may be receiving benefits at the same time, or they may take them at different times. For a biological mother, application may be made for both the maternal benefit and parental benefit at the same time, allowing for seamless continuity from one benefit to the other.

Benefits may begin the week of the date of birth, or the week of placement in the case of an adoption. Benefits are available/measured in weeks, but do not have to be taken consecutively, allowing parents to start and stop according to their circumstances. There is a time limit by which all benefit weeks must be taken, based on either the standard option, or the extended option that pays less for a longer time:

-

- Standard parental option – All benefit weeks must be taken within 52 weeks (being 12 months)

- Extended parental option – Benefit weeks may be taken for as long as 78 weeks (being 18 months)

Once an option has been chosen and paid to either parent, the clock starts running on that time limit. As well, the option cannot be changed after payment begins, and the other parent must use that same option.

As between them, there is a maximum number of weeks any one parent may claim, being 35 for the standard option and 61 for the extended option. This condition accompanied the increase in the number of benefit weeks from 35 to 40 weeks and 61 to 69 weeks for the two benefit options respectively, as announced in the 2018 Federal Budget. The purpose of this condition/limit is to encourage more equitable sharing of parental responsibilities.

Further key details of both parental options and the maternity benefit are shown in the table on the following page.

Summary table by type of benefit

– For 2024

Personal savings strategies to get you to and through baby’s arrival

Inevitably a new child means new costs, though some lifestyle expenses may drop off as your time and attention are diverted. The net cost may be ambiguous, but most certainly your income will be less. The prudent course is to establish a savings routine early on:

-

- As soon as you decide or become aware of your new addition, sit down together as parents-to-be and review your financial picture, ideally with the assistance of a financial advisor. While you may have managed without a budget in the past, parenthood will be extra difficult to navigate without good financial organization.

- Inform yourself about the kind of products and services you may need during pregnancy and after birth/arrival. You can start by asking your own parents about their experiences, but be sure to update to the present. Beyond allowing for cost inflation over the intervening generation, educate yourself on current nutrition and healthcare practices, and safety devices (e.g. sleeping furniture, car seats), both legally-mandated and as recommended by recognized experts. Also, be cautiously skeptical about any gadget offerings you come across, some which may indeed save time and money, and others that may make you net worse-off for using them.

- Arrive at a reasonable target for your planned weekly spending once baby arrives, and think carefully how long you will be away from work. On the income side, remember that the most you will receive from EI is just over half of your working income, and at a time when new expenses often crop up. Total up the potential weekly shortfall and multiply by the number of weeks you expect to be away from full-time work.

- Divide the total shortfall above by the number of weeks from the present until you plan to begin your maternity/parental leave. That will tell you how much to save each week to accumulate exactly enough to carry you through the post-arrival time period. Don’t panic if this is a stretch. Rather, use it reinform your assumptions and intentions, and if necessary to motivate you to identify other savings sources to tap into.