On Tuesday April 16, 2024, Finance Minister Chrystia Freeland tabled the Liberal government’s 2024-25 Federal Budget in Parliament, entitled “Fairness For Every Generation”.

Budget 2024 expands on the many announcements made in recent weeks, with leading themes of housing affordability, cost of living, employment opportunities, and small business growth – all with particular emphasis on younger generations. With all the announced spending, the big question remaining for Budget Day has been how it would be paid for. The answer, at least in part, is an increase in the inclusion rate for capital gains realized by trusts, corporations and high-income individuals.

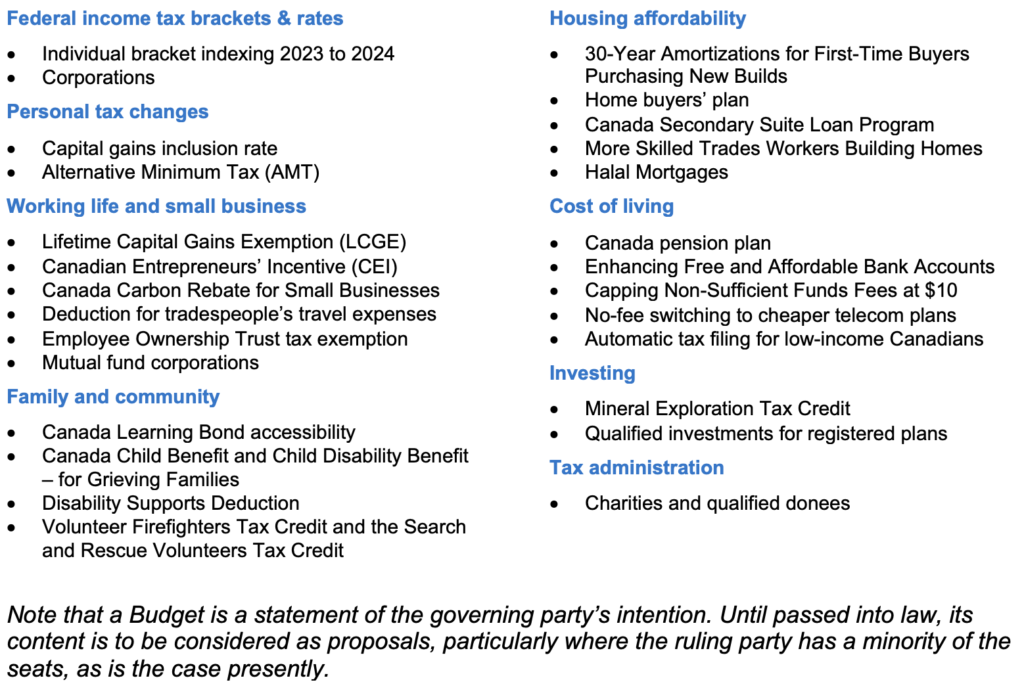

This summary highlights provisions relevant to savings, investment and financial planning of individuals, families and small businesses. We begin with a summary of current tax rates, then turn to the Budget’s themes:

Federal income tax brackets & rates

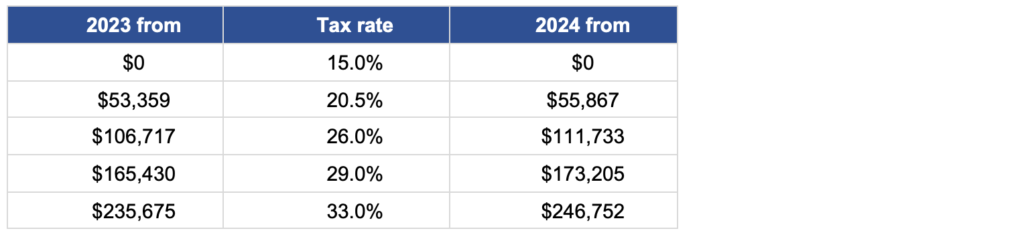

Individual bracket indexing 2023 to 2024

There were no changes to personal income tax rates, other than normal annual indexing. Personal brackets have been indexed by 4.7% over 2023 levels. For 2024, the basic personal amount/credit is $15,705, incrementally reduced as income exceeds the 29% fourth bracket to $14,156 once income reaches the 33% bracket threshold.

Corporations

The general rate remains 15%, and the small business rate remains 9% on the first $500,000 of taxable income.

Personal tax changes

Capital gains inclusion rate

Currently when a capital gain arises, half of the gain is untaxed and the other half is included in taxable income. The one-half inclusion rate also applies to capital losses.

Budget 2024 proposes to increase the inclusion rate to two-thirds:

-

- For corporations and trusts, on all capital gains realized in a year, and

- For individuals, on the portion of capital gains realized in the year that exceed $250,000, applicable to capital gains realized on or after June 25, 2024.

For those who claim the employee stock option deduction, there would be a one-third deduction of the taxable benefit to reflect the new capital gains inclusion rate. The individual would then be entitled to a deduction of one half the taxable benefit up to a combined limit of $250,000 for both employee stock options and capital gains.

Net capital losses of prior years would continue to be deductible against taxable capital gains in the current year by adjusting their value to reflect the inclusion rate of the capital gains being offset. In this way, a capital loss realized prior to the rate change would fully offset an equivalent capital gain realized after the rate change.

Two different inclusion rates would apply when June 25, 2024 is within a taxpayer’s tax year. Separate capital gain/loss calculations would be required for ‘Period 1’ before the effective date, and ‘Period 2’ thereafter, with the higher inclusion rate applying to the latter period. For individuals, the $250,000 threshold would be fully available in 2024 (i.e., it would not be prorated), and would apply only to net capital gains realized in Period 2.

Alternative Minimum Tax

Budget 2023 announced changes to the Alternative Minimum Tax (AMT) calculation, for which draft legislation was published for consultation. Following from that, further amendments are proposed in this Budget 2024, including:

-

- Revising the tax treatment of charitable donations to allow individuals to claim 80% (instead of the previously proposed 50%) of the charitable donation tax credit when calculating AMT;

- Allowing full deductions for the Guaranteed Income Supplement, social assistance, and workers’ compensation payments;

- Allowing individuals to fully claim the federal logging tax credit under the AMT;

- Fully exempting Employee Ownership Trusts from the AMT; and

- Allowing certain disallowed credits under the AMT to be eligible for the AMT carry-forward (i.e., the federal political contribution tax credit, investment tax credits, and labour-sponsored funds tax credit).

These amendments would apply to taxation years that begin on or after January 1, 2024 (i.e., the same day as the broader AMT amendments).

In addition, the government is soliciting stakeholders’ views on proposed exemptions for Indigenous settlement and community trusts. Interested parties are invited to send written representations to the Department of Finance Canada, Tax Policy Branch at consultation.legislation@fin.gc.ca by June 28, 2024.

Working life and small business

Lifetime Capital Gains Exemption

The Lifetime Capital Gains Exemption (LCGE) protects against the taxation of capital gains on the disposition of qualified small business corporation shares and qualified farm or fishing property. The exemption is $1,016,836 in 2024 and is indexed to inflation.

The Budget proposes to increase the LCGE to apply to up to $1.25 million of eligible capital gains. This measure would apply to dispositions that occur on or after June 25, 2024. Indexation of the LCGE would resume in 2026.

Canadian Entrepreneurs’ Incentive

Budget 2024 proposes a new Canadian Entrepreneurs’ Incentive – available on a lifetime basis in addition to the LCGE – intended to reduce the tax rate on capital gains on the disposition of qualifying shares by an eligible individual. Specifically, it would provide for a capital gains inclusion rate that is one half the prevailing inclusion rate, on up to $2 million in capital gains per individual over their lifetime. Under the two-thirds capital gains inclusion rate proposed in Budget 2024, this measure would result in an inclusion rate of one third for qualifying dispositions.

The lifetime limit would be phased in by increments of $200,000 per year, beginning on January 1, 2025, before ultimately reaching a value of $2 million by January 1, 2034.

This measure would apply to dispositions that occur on or after January 1, 2025.

Canada Carbon Rebate for Small Businesses

Budget 2024 proposes a new tax credit, the Canada Carbon Rebate for Small Businesses. With respect to the 2019-20 to 2023-24 fuel charge years, the credit would be available to a Canadian-controlled private corporation (CCPC) that files a tax return for its 2023 taxation year by July 15, 2024. To be eligible, the CCPC would need to have had no more than 499 employees throughout Canada in the calendar year in which the fuel charge year begins.

The tax credit would apply to future fuel charge years, including 2024-25, in a similar manner.

Deduction for tradespeople’s travel expenses

Eligible tradespeople and apprentices in the construction industry are currently able to deduct up to $4,000 in eligible travel and relocation expenses per year by claiming the Labour Mobility Deduction for Tradespeople. Separate legislation allows unlimited travel expense claims for such persons.

The government will consider bringing amendments to harmonize the provisions.

Employee Ownership Trust tax exemption

Budget 2023 proposed tax rules to facilitate the creation of employee ownership trusts (EOTs).

Budget 2024 provides further details on the proposed exemption and conditions, enabling one or more individuals who satisfy the conditions to claim an exemption for up to $10 million in capital gains from a sale of shares. This also clarifies the interaction with the amended Alternative Minimum Tax, and its application to a Worker Cooperative.

This measure would apply to qualifying dispositions of shares that occur between January 1, 2024 and December 31, 2026.

Mutual fund corporations

The Income Tax Act includes special rules for mutual fund corporations that facilitate conduit treatment for investors (shareholders). These conditions are premised on the idea of a mutual fund corporation being widely held. However, a corporation controlled by a corporate group may qualify as a mutual fund corporation even though it is not widely held, enabling unintended access to the flow-through of income.

Budget 2024 proposes to amend the Income Tax Act to preclude a corporation from qualifying as a mutual fund corporation where it is controlled by or for the benefit of a corporate group. Exceptions would be provided to ensure that this does not adversely affect mutual fund corporations that are widely held pooled investment vehicles.

This measure would apply to taxation years that begin after 2024.

Family and community

Canada Learning Bond accessibility

The Canada Learning Bond (CLB) provides up to $2,000 to help with the education of children in low-income families. Despite that no family contribution is necessary, the uptake of the CLB is lower than it could be.

To address this, the government intends to amend the Canada Education Savings Act to introduce automatic enrolment in the CLB for eligible children who do not have a Registered Education Savings Plan opened for them by the age of four. As well, the age to retroactively claim the CLB will be extended from 20 to 30 years.

Canada Child Benefit and Child Disability Benefit – for Grieving Families

Presently, eligibility for the Canada Child Benefit (CCB) ceases the month after a child dies. This puts grieving parents and families in a difficult position to immediately inform authorities, with the result that overpayment and repayment situations can result.

Budget 2024 proposes to extend eligibility for the CCB in respect of a child for six months after a child’s death. A CCB recipient would still be required to notify the CRA of their child’s death before the end of the month following the month of their child’s death to curtail potential overpayments beyond the extended period. This would also apply to the Child Disability Benefit, which is paid with the CCB in respect of a child eligible for the Disability Tax Credit.

This measure would be effective for child deaths that occur after 2024.

Disability Supports Deduction

The Disability Supports Deduction allows individuals who have an impairment in physical or mental functions to deduct certain expenses that enable them to earn business or employment income or to attend school.

Budget 2024 proposes to expand the list of expenses recognized, including expenses for service animals, and to allow the claim to be made under either the Medical Expense Tax Credit or the Disability Supports Deduction.

This measure would apply to the 2024 and subsequent taxation years.

Volunteer Firefighters Tax Credit and the Search and Rescue Volunteers Tax Credit

Budget 2024 proposes to double the credit amount for the Volunteer Firefighters Tax Credit and the Search and Rescue Volunteers Tax Credit to $6,000. This would increase the maximum tax relief to $900.

This enhancement would apply to the 2024 and subsequent taxation years.

Housing affordability

30-Year Amortizations for First-Time Buyers Purchasing New Builds

Budget 2024 announces the government will allow 30-year mortgage amortizations for first-time home buyers purchasing newly constructed homes. This new insured mortgage product will be available to first-time buyers starting August 1, 2024.

Home buyers’ plan

Budget 2024 proposes to increase the withdrawal limit from $35,000 to $60,000. This increase would also apply to withdrawals made for the benefit of a disabled individual who does not have to be a first-time buyer.

This measure would apply to the 2024 and subsequent calendar years for withdrawals made after Budget Day.

As well, the Budget proposes a temporary deferral of the start of the 15-year repayment period by an additional three years for participants making a first withdrawal between January 1, 2022, and December 31, 2025.

Canada Secondary Suite Loan Program

Homeowners may have a basement, garage or other unused liveable space they would like to convert into a rental suite. While the ultimate result may provide a net positive impact, the upfront cost and expected administrative red tape may dissuade them from taking action.

Budget 2024 proposes to provide $409.6 million over four years, starting in 2025-26, to the Canada Mortgage and Housing Corporation to launch a new Canada Secondary Suite Loan Program, enabling homeowners to access up to $40,000 in low-interest loans to add secondary suites to their homes.

More Skilled Trades Workers Building Homes

There is a significant need for skilled trade workers, particularly in the home building industry. This can be a rewarding career, both personally and financially, for a young person considering where to apply their efforts, but it can also be challenging to get established.

Budget 2024 proposes to provide $100 million over two years, starting in 2024-25 for the Apprenticeship Service to help create placements with small and medium-sized enterprises for apprentices. This is to be complemented by the Skilled Trades Awareness and Readiness Program to encourage individuals to explore and prepare for careers in the skilled trades, supported by interest-free Canada Apprentice Loan and Employment Insurance Regular Benefits for apprentices on full-time technical training.

Halal Mortgages

Traditional mortgages may conflict with some peoples’ beliefs and their religious laws. Halal mortgages enable Muslim Canadians and other diverse communities to further participate in the housing market.

Budget 2024 announces that the government is exploring new measures to expand access to alternative financing products, like halal mortgages. This could include changes in the tax treatment of these products or a new regulatory sandbox for financial service providers, while ensuring adequate consumer protections are in place.

Cost of living

Canada pension plan

Part of the governance of the Canada Pension Plan is to conduct a Triennial Review. Following from the most recent 2022-24 review, Budget 2024 announces that the federal government, in coordination with provincial partners, proposes to make technical amendments to the CPP legislation, including:

-

- Providing a top-up to the Death Benefit for certain contributors;

- Introducing a partial children’s benefit for part-time students;

- Extending eligibility for the disabled contributors children’s benefit when a parent reaches age 65; and,

- Ending eligibility for a survivor pension to people who are legally separated after a division of pensionable earnings.

Enhancing Free and Affordable Bank Accounts

To ensure affordable banking options meet the needs of Canadians, the government directed the Financial Consumer Agency of Canada (FCAC) to secure new agreements from financial institutions for enhanced free and affordable banking accounts.

The FCAC is presently in negotiations with banks to secure enhanced agreements to offer modernized $0 per month and up to $4 per month bank accounts that reflect the realities of banking today, including more transactions, as well as expanded eligibility for $0 accounts. The existing agreement with ten banks offers the same features as low-cost accounts to the following groups for free:

-

- Youth;

- Students;

- Seniors receiving the Guaranteed Income Supplement (GIS); and,

- Registered Disability Savings Plan (RDSP) beneficiaries.

Capping Non-Sufficient Funds Fees at $10

To help Canadians who are struggling to make payments to improve their financial situation, the government is announcing its intent to cap the Non-Sufficient Funds (NSF) fees charged by banks to $10 per instance, as well as:

-

- Requiring banks to alert consumers that they are about to be charged an NSF fee, and providing a grace period to deposit additional funds to avoid the fee;

- Prohibiting multiple NSF fees when the same transaction reoccurs;

- Restricting the number of NSF fees that may be charged to one in every 72-hour period; and,

- Prohibiting NSF fees for small overdrawn amounts under $10.

No-fee switching to cheaper telecom plans

Budget 2024 announces the government’s intention to amend the Telecommunications Act to better allow Canadians to renew or switch between home internet, home phone, and cell phone plans:

-

- Carriers will be prohibited by the CRTC from charging consumers extra fees to switch carriers.

- Carriers will be required to help consumers identify plans, which may include lower-cost plans, in advance of the end of a contract.

- Carriers will also be required to provide a self-service option, such as an online portal, for customers to easily switch between or end plans with a provider.

Automatic tax filing for low-income Canadians

In February 2024, the Canada Revenue Agency (CRA) increased the number of eligible Canadians for SimpleFile by Phone (formerly File My Return) to 1.5 million people, more than double the number of people eligible last year. The CRA is on track to increase this number to two million by 2025.

In summer 2024, the CRA will pilot new automatic filing services, SimpleFile Digital and SimpleFile by Paper, to help more Canadians who do not currently file their taxes receive their benefits.

Investing

Mineral Exploration Tax Credit

Flow-through shares allow resource companies to renounce or “flow through” tax expenses associated with their Canadian exploration activities to investors, who can deduct the expenses in calculating their own taxable income.

As currently legislated, the Mineral Exploration Tax Credit will expire on March 31, 2024. Budget 2024 extends eligibility for one year, to flow-through share agreements entered into on or before March 31, 2025.

Qualified investments for registered plans

Since 1966, qualified investment rules have defined what may be held in registered accounts. These rules have been incrementally expanded to include more than 40 types of assets and to reflect the introduction of new types of registered plans (including TFSAs in 2009 and FHSAs in 2023).

However, this incremental approach has resulted in qualified investment rules that can be inconsistent or difficult to understand in some cases. Budget 2024 invites stakeholders to provide suggestions on how the qualified investment rules could be modernized on a prospective basis to improve the clarity and coherence of the registered plans regime. Stakeholders are invited to submit comments to QI-consultation-PA@fin.gc.ca by July 15, 2024.

Tax administration

Charities and qualified donees

Budget 2024 proposes amendments designed to assist registered charities in fulfilling their tax compliance responsibilities, including opting to receive certain official notices digitally from CRA. Charities will be expressly permitted to issue official donation receipts electronically, and will no longer be required to show:

-

- Place of issuance of the receipt;

- Name and address of the appraiser, if an appraisal of the donated property has been done; and

- Middle initial of the donor.

As well, the period for which qualifying foreign charities are granted status as a qualified donee is to be extended from 24 months to 36 months.