Public assistance, tax relief and coordinated private planning

People with physical and mental disabilities often face serious financial challenges due to earning limitations and direct out-of-pocket costs. Fortunately, government support is available, as summarized below. Unless noted otherwise, all figures are for programs and federal tax credits for the 2024 tax year, rounded to the nearest dollar.

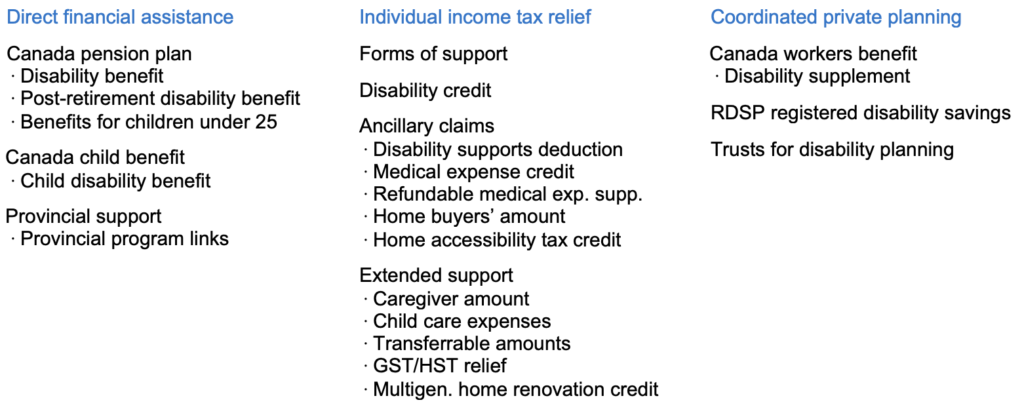

With support delivered in multiples ways, from both provincial and federal sources, it can be difficult to determine what, how and how much may be available. To help you navigate, the material in this document is broken into three major topics below. Hyperlinks to official sources are included in the subtopic descriptions, with full text of those links in the appendix:

Direct financial assistance

Canada pension plan

The Canada pension plan (CPP) is a social insurance plan providing income replacement to contributors and their families in the event of retirement, disability or death. It is government-run, but funded by mandatory employee and employer premiums.

CPP disability benefit [1]

The CPP disability benefit is available to people under age 65 not receiving a CPP retirement pension who have made recent CPP premium payments while working. Generally, this means contributions in four of the last six years, or contributions for at least 25 years, including three of the last six years.

The disability must be both:

-

- severe (a person is incapable of regularly pursuing any substantially gainful occupation); and

- prolonged (long-term and of indefinite duration or is likely to result in death).

The monthly disability benefit is a basic amount, plus an addition based on the person’s past CPP premiums. Currently, the base is $583, with the maximum at $1,607. When the person turns 65, the CPP disability benefit is automatically changed to a CPP retirement pension.

CPP post-retirement disability benefit [2]

A person 60 to 65 with a CPP retirement pension for more than 15 months is not eligible for the CPP disability benefit. Instead, if the definition for disability and minimum contribution requirements are met, the post-retirement disability benefit (PRDB) is paid as a $583 flat rate. The application is the same as for the CPP disability benefit.

Benefits for children under 25 [3]

The CPP children’s benefits provide monthly payments to the dependent children of disabled or deceased CPP contributors. The disabled contributor’s child’s benefit, currently $294, is for a child of a person receiving a CPP disability benefit. Though related to the disabled contributor’s own claim, this is a separate application form and process. It is taxable to the child, even if received by a parent or guardian on the child’s behalf. The child must be under age 18, or under 25 if attending a qualifying post-secondary educational institution.

Canada child benefit

The Canada child benefit (CCB) is a tax-free payment made to eligible families by the federal government to help with the cost of raising children under 18 years of age. The maximum amounts are progressively reduced as family net income (FNI) exceeds indexed annual thresholds. Amounts for 2024 are:

-

- For July 2023 to June 2024, $620 for a child under 6, and $523 for a child between 6 and 17, reduced as 2022 FNI exceeds $34,863

- For July 2024 to June 2025, $649 for a child under 6, and $548 for a child between 6 and 17, reduced as 2023 FNI exceeds $36,502

The CCB may include the child disability benefit (CDB) and related provincial/territorial programs.

Child disability benefit (CDB) [4]

The CDB is available to families with children qualifying for the disability credit (see below). Amounts for 2023 are:

-

- For July 2023 to June 2024, $264 per child each month, reduced as 2022 FNI exceeds $75,537

- For July 2024 to June 2025, $277 per child each month, reduced as 2023 FNI exceeds $79,087

To qualify, Form T2201 must be completed by a qualified health professional and submitted to the Canada Revenue Agency (CRA) for approval. The payment is then delivered as part of the monthly CCB payment.

Provincial support programs

Some provinces have standalone disability support programs, while others recognize disability as a special qualification within the broader social support system. Generally, a licensed physician using provincially prescribed criteria and forms must certify the disability. Provincial approaches vary in terms of service offerings, cost reimbursements, rates for family size and composition, and direct financial assistance.

Entitlement is reduced or eliminated where earnings or assets exceed regulated thresholds, though some provinces will disregard assets held in a discretionary trust for the disabled person (ie., Henson trust, discussed below). To determine provincial resources, consult these program links: [5]

British Columbia – Disability assistance

Alberta – Assured Income for the Severely Handicapped (AISH)

Saskatchewan – Saskatchewan Assured Income for Disability (SAID)

Manitoba – Employment and Income Assistance for Persons with Disabilities

Ontario – Ontario Disability Support Program (ODSP)

Quebec – Ministère du Travail, de l’Emploi et de la Solidarité sociale (general)

New Brunswick – Family Income Security Act – Extended Benefits Program

Nova Scotia – Disability Support Program

Prince Edward Island – AccessAbility Supports

Newfoundland and Labrador – Persons with Disabilities & Income Support, Rates

Individual income tax relief

Forms of support [6]

Tax measures commonly available to assist persons with disabilities fall into three categories:

-

- Deductions –

Qualifying items reduce the taxable income upon which relevant federal and provincial tax rates are applied. - Non-refundable tax credits –

Once a person’s tax liability is calculated, credits are applied to reduce that liability but cannot take it below zero. The qualifying amount is multiplied by the applicable federal or provincial rate (usually the lowest bracket rate) to calculate the credit value. The federal credit rate is 15%. - Refundable tax credits –

As above, the qualifying amount is multiplied by the applicable federal or provincial rate. The resulting value is first applied to reduce the individual’s tax due, and if there is any left over after the tax liability has been reduced to zero, the remainder is paid to the taxpayer.

- Deductions –

The following is an outline of the key items and their potential dollar values (often income-dependent), though it does not cover all possibilities. For a comprehensive view, including detailed qualification criteria, consult Guide RC4064 Disability-Related Information. [7]

Disability tax credit (DTC) [8]

This is a non-refundable credit, available both federally and provincially. Using tax form T2201, the disability must be certified by a qualified medical practitioner as being both severe (i.e., blindness, conditions requiring life-sustaining therapy, a marked restriction in speaking or hearing, walking, feeding, dressing, elimination or a marked restriction in everyday mental functions) and prolonged (lasting, or expected to last, continuously for at least 12 months).

The basic federal amount is $9,872. A supplement worth as much as $5,758 may be available for children under age 18, though the value is reduced if certain child and attendant care expenses are claimed for the child.

When multiplied by the credit rate, the maximum value for the DTC is $1,481 and for the supplement $864, for as much as $2,345 total.

Ancillary claims

Disability supports deduction [9]

A disabled person may deduct qualifying out-of-pocket expenses incurred to work, go to school or conduct grant-supported research. The person may not deduct amounts already claimed under the medical expense credit (whether claimed personally or on his behalf as a dependant), or amounts already reimbursed by health insurance plans or through other non-taxable payments. Generally, the deduction cannot exceed the person’s earned income for the year, calculated using CRA Form T929.

Medical expense credit [10]

A person may claim eligible medical expenses, whether incurred in Canada or elsewhere, that will be paid in any 12-month period.

Special rules apply to attendant care expenses, and whether the care was received at home or in a facility. This is a non-refundable tax credit, equal to expenses that exceed the lesser of $2,759, (indexed annually) and 3% of the disabled person’s net income. Each province uses as similar lesser-of a prescribed dollar amount and 3% of net income. Quebec applies the credit on qualifying expense amounts over 3% of family net income.

Eligible expenditures can be claimed either under this medical expense credit calculation or as a disability support deduction, but not both. Accordingly, run a test calculation to determine which of the two yields the best net tax result.

Refundable medical expense supplement [11]

This is a refundable credit designed to assist people with low incomes who claim either the disability supports deduction or the medical expense credit. Subject to a clawback where family net income exceeds $32,419, this federal credit can be worth as much as $1,464.

Home buyers’ amount [12]

A credit amount of $10,000 (value $1,500 as a non-refundable tax credit) is available for first-time purchasers of a qualifying home. You do not have to be a first-time buyer if you are eligible for the DTC or you bought the home for the benefit of a related person who is eligible for the DTC. However, the purchase must be to allow the person with the disability to live in a home that is more accessible or better suited to his or her needs.

Home accessibility tax credit [13]

This non-refundable credit is worth up to $3,000, based on a $20,000 amount. It is for eligible home renovations if they allow a person to gain access to or be more mobile or functional within the home, or if the renovations reduce the risk of harm within the home. The eligible person must be 65 or older, or be eligible for the DTC. The credit may be claimed by that person, or by a homeowner who supports the eligible dependent person if certain criteria are met.

Extended support

Caregiver amount

The Caregiver amount is a non-refundable tax credit that may be available to a person who supports a person with a physical or mental impairment. The amount and value of the credit are determined based on the dependant the taxpayer is supporting.

For care of a dependent spouse/common-law partner (CLP) the spouse/CLP amount is increased by $2,616. For a minor child or grandchild, the amount for an eligible dependant is similarly increased by $2,616. In either case, the value of the credit is $392. Depending on the dependent’s net income, the amount on which the credit is calculated can be up to $8,375, worth up to $1,256. [14]

If you are caring for your or your spouse/CLP’s dependent relatives (parent, sibling, adult child or certain specified relatives) 18 years of age or older with infirmities, the amount is $8,375, worth up to $1,256. [15]

Child care expenses [16]

Child care expenses may be deductible if incurred so that a parent may earn income, run a business, attend school or conduct certain research activities. The calculation of this credit can be complicated, even without disability issues to consider. For present purposes, be aware that there are provisions to guard against concurrent claims being made for the disability amount or the medical expense credit.

Transferrable amounts [17]

A person may be able to claim certain amounts, notably the disability credit and the medical expense credit, transferred from a spouse, common-law partner or dependant.

GST/HST relief [18]

Many goods and services used by persons with disabilities are not subject to GST or HST, whether by exemption or rebate. Here’s a list of what’s qualified:

-

- most health care services;

- personal care and supervision programs while a primary caregiver is working;

- prepared meal delivery programs;

- public sector recreational programs designed for persons with disabilities; and

- medical devices, supplies and specially-equipped vehicles.

Multigenerational home renovation tax credit [19]

Effective for 2023 and following years, this refundable credit is available for renovations that create a secondary dwelling unit to permit an eligible person (a senior or a person with a disability) to live with a qualifying relation. It is calculated on the lesser of eligible expenses incurred and $50,000, making it worth up to $7,500. The credit can be claimed by either the eligible person or a qualifying relation. One qualifying renovation is permitted to be claimed in respect of an eligible person over their lifetime, as compared to the Home accessibility credit (discussed above) which may be claimed annually.

Coordinated private planning

To optimize access and use of government financial and tax supports, individuals and families must manage their income and assets. This includes: family estate planning, up-to-date wills, informed beneficiary designations, executing powers of attorney, and establishing appropriate trusts.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit designed to assist low-income working individuals and families. There is a basic amount that can be claimed if family working income is more than $3,000, and a disability supplement. For 2023, it is worth up to $1,518 for individuals (reduced as individual adjusted net income exceeds $24,975) or $2,616 for families (reduced as adjusted family net income exceeds $28,494).

Disability supplement [20]

A person eligible to claim the disability credit may be able to claim the disability supplement on top of the CWB basic amount. It can be claimed if individual working income is more than $1,150. For 2023, it is worth up to $784 for either individuals or families, and may be reduced as individual adjusted net income exceeds $35,095, or adjusted family net income exceeds $45,934.

Registered Disability Savings Plan (RDSP) [21]

An RDSP may be established for a person under 59 who qualifies for the disability tax credit. The maximum lifetime contribution is $200,000, complemented by government support of up to $20,000 in free Canada disability savings bond (CDSB) money and $70,000 in matching Canada disability savings grant (CDSG) money. The CDSG and CBSB are available until the year the disabled beneficiary turns 49.

The government support is subject to the beneficiary’s adjusted family net income (AFNI), or the parents’ AFNI if the person is under age 18. As an example using the government’s most recently published data,

-

- If 2023 AFNI is less than $106,717, a $1,500 contribution in the year will attract $3,500 of CDSG.

- If 2023 AFNI is less than $34,863, the government will contribute $1,000 of CDSB, regardless of personal contributions.

Contributions will most commonly be made directly from after-tax funds, but may also be by transfer from an RESP or through a beneficiary designation from a parent’s RRSP/RRIF. Amounts from an RRSP/RRIF roll over tax-free but do not qualify for CDSG matching, and will be taxable on eventual withdrawal. All contributed amounts grow tax-free, and are eventually paid out to, or for, the disabled beneficiary. Taxable amounts are reported by the beneficiary, which generally means very little tax is paid.

All provinces disregard RDSP assets when determining entitlement to provincial disability income support. Most provinces also exempt any income taken from RDSPs when calculating the amount of such support, but the exemption is only partial in New Brunswick, Prince Edward Island and Québec.

Trusts for disability planning

A trust separates legal ownership of property from beneficial ownership, allowing a trustee to manage the needs of someone who may be incapable of, or unsuitable to be managing property personally. An application mentioned above is a discretionary ‘Henson’ trust that can help preserve income from a provincial disability support program. As well, trust can receive preferred tax treatment when a/the beneficiary has a disability. Sometimes maximizing public support and optimizing taxes are complementary, and other times there may be trade-offs.

For an in-depth discussion of this topic, please see the companion article Disability needs planning using trusts.

Appendix – Hyperlinks to official sources

-

- https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-disability-benefit.html

- https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-post-retirement.html

- https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-childrens-benefit.html

- https://www.canada.ca/en/revenue-agency/services/child-family-benefits/child-disability-benefit.html

- Provincial support programs

- https://www2.gov.bc.ca/gov/content/family-social-supports/services-for-people-with-disabilities/disability-assistance

- https://www.alberta.ca/aish.aspx

- https://www.saskatchewan.ca/residents/family-and-social-support/people-with-disabilities/income-support-for-people-with-disabilities

- https://www.gov.mb.ca/fs/eia/eia_disability.html

- https://www.mcss.gov.on.ca/en/mcss/programs/social/odsp/index.aspx

- https://www.mtess.gouv.qc.ca/secteurs_act_en.asp

- https://www2.gnb.ca/content/dam/gnb/Departments/sd-ds/pdf/SocialAssistance/ScheduleA-AnnexeA.pdf

- https://novascotia.ca/coms/disabilities/DSP-standard-household-rate.html

- https://www.princeedwardisland.ca/en/information/social-development-and-housing/accessability-supports

- https://www.gov.nl.ca/isl/disabilities/ & https://www.gov.nl.ca/isl/income-support/overview/#monthlyrates

- https://www.canada.ca/en/financial-consumer-agency/services/financial-toolkit/taxes/taxes-3.html

- https://www.canada.ca/content/dam/cra-arc/formspubs/pub/rc4064/rc4064-21e.pdf

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/disability-tax-credit.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-21500-disability-supports-deduction.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-33099-33199-eligible-medical-expenses-you-claim-on-your-tax-return.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-45200-refundable-medical-expense-supplement.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31270-home-buyers-amount.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31285-home-accessibility-expenses.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-30425-caregiver-spouse-dependant.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-30450-caregiver-infirm-dependant.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-21400-child-care-expenses.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-32600-amounts-transferred-your-spouse-common-law-partner/you-claim-transfer-certain-amounts-your-spouse-common-law-partner.html

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/gst-hst-information.html

- https://budget.gc.ca/2022/report-rapport/chap1-en.html#m9

- https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/5000-s6/5000-s6-23e.pdf

- https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-disability-savings-plan-rdsp.html