Operational efficiency to investible surplus

Apart from pursing a passion, the purpose of running a business is to generate income. To the point, eventually you intend on spending what your hard work produces, and using the excess to invest in yourself and your future.

Sometimes the route from contributed capital to surplus cash is quick, direct and transparent. More often though, invested cash takes on a variety of forms as it travels through the enterprise before emerging as profit. How complex that route is and how long it takes depends on the scope and scale of the business.

That being the case, it can be difficult to determine when, where and how to use portfolio investments in a corporation.

That being the case, it can be difficult to determine when, where and how to use portfolio investments in a corporation.

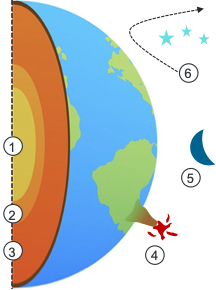

It may help to use the analogy of the earth and its gravitational pull to follow the movement of cash through a corporation.

Operational efficiency –

Running the business

1. Inner core

Cash cycles through current assets such as prepaid expenses, inventory, and accounts receivable, and is applied to current liabilities as they come due. Some may be held in physical currency, but its use is more practically facilitated through deposits and short-term credit tools.

2. Outer core

Working capital is the continuous float – the ebb and flow between current assets and liabilities – that keeps a business running. Usually it is supported by a revolving line of credit so that the owner can focus on the business, and not accounting balances.

Working capital is not itself investible, but to the extent that efficiencies are applied (eg., timely use of payment terms, prompt account collections, optimal inventory levels, smart foreign exchange practices, etc.), more cash may be freed up to move up and out of a corporation.

3. Mantle & crust

Long-term assets are the structure within which the business produces its wares. They last for many years, but eventually have to be replaced in order to sustain productive capacity.

The cost of replacement is commonly managed through a combination of asset-backed loans and capital reserves. To assure that reserves are available when needed, safety and liquidity are the top priorities.

Investible surplus –

Breaking the business’ gravitational pull

4. Surface

Retained earnings is the after-tax money of the corporation. The portion of it that is not needed for business operations or capital reserves may be appropriate for passive portfolio investment.

5. Orbiting

A holding company may receive tax-free inter-corporate dividends on shares it holds in an operating company. This puts the extracted funds beyond the reach of operating company creditors, so may be a preferred place for portfolio investments. Where there is more than one business owner, each might establish a holding company so that respective funds and investment portfolios may be isolated.

6. Beyond gravity

Dividends to a shareholder may be placed in a personal non-registered investment account. Such dividends are taxable, meaning the personal investible amount is less than if it remained in a corporation. On the other hand, investment returns are taxed less favourably in a corporation, and sooner or later will have to cross that threshold for shareholder personal use. Tax advice is a must.