Added flexibility for your tax-sheltered savings

The TFSA is a flexible savings plan that can be used – and re-used – for any savings purpose over a person’s lifetime. Qualified investments include deposits, guaranteed investment certificates, stocks, bonds, mutual funds and segregated funds.

Compared to other registered plans, the TFSA has relatively few rules to understand and follow.

Key tax features

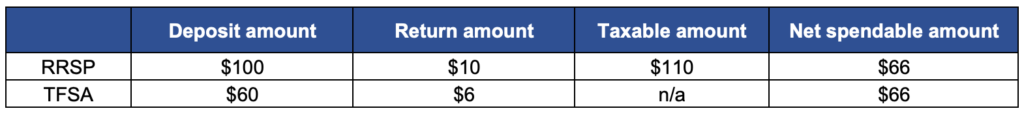

Whereas RRSP contributions are deductible in the year made, and withdrawals are eventually taxable, for TFSAs:

-

- Contributions are after-tax, meaning they are NOT deductible in calculating income

- Income in the plan is tax-sheltered, unlike RRSPs for which income is tax-deferred until withdrawn

- Withdrawals are NOT taxed no matter when taken, and do not affect income-tested public support payments

Who can invest money in a TFSA?

To contribute to a TFSA, you must be a Canadian resident who is at least 18 years old and has a Social Insurance Number (SIN). Even foreign citizens who are resident in Canada qualify, though their home country rules may subject a TFSA to tax. If the age of majority to enter a contract is 19 in your province, the allotted TFSA room for age 18 carries forward to be used in a future year.

Unlike RRSPs which prohibit contributions after age 71, there is no upper age limit for TFSAs.

No tax applies if you become a non-resident of Canada, but you may not make contributions while a non-resident, nor are you credited with annual room. A 1% per-month penalty tax applies to non-resident contributions.

Contributions and withdrawals

From age 18, every Canadian resident is entitled to an allotment of annual TFSA room, which began at $5,000 in 2009. Other than 2015 when the annual room jumped to $10,000 (an election year goodie), that annual room is indexed in a way that rounds to the nearest $500 every few years, and currently stands at $7,000 for 2024. Unused room carries forward for use in any future year. For someone who has been eligible since the TFSA became available in 2009 but has not made any contributions, the cumulative room is $95,000 in 2024.

If you exceed your limit, there is a 1% penalty tax on your highest excess amount each month.

In addition to cash contributions, you may transfer securities in-kind to a TFSA, but the transaction may trigger tax. From a non-registered account, there is a deemed disposition at fair market value (FMV) that may result in a taxable capital gain, or if it comes from your RRSP it will be a taxable withdrawal at FMV.

If you borrow to contribute, the Income Tax Act (ITA) does not allow a deduction for the loan interest. This principle is based on the fact that the corresponding TFSA income is not taxable.

Credit for re-contribution

When you withdraw money from a TFSA, you receive a dollar-for-dollar re-contribution credit. This allows you to build savings and use them for a current need, and use that same room again in future. Be aware though that the credit is effective January 1st of the following year. If you plan to re-contribute sooner than that, make sure you have sufficient room separate from this credit, or you could be exposed to that over-contribution penalty.

Lifetime gifts and transfers

Generally, if you make a gift to a spouse/common-law partner (CLP) for investing, the ITA income attribution rules cause you the giver to be taxed on any resulting investment income. However, those attribution rules do not apply if the recipient spouse/CLP places that gift into a TFSA.

In fact, you can give money to anyone to contribute into their own TFSA, without any attribution concern. However, once money is in a TFSA, it cannot normally be transferred as a TFSA directly from one person to another.

But there is an exception that does allow for the transfer of a TFSA in the case of a spouse/CLP relationship breakdown. In that situation, the recipient spouse/CLP receives the transferred TFSA (which continues to be treated as a TFSA) and his/her existing contribution room remains as is. Unfortunately for the transferor spouse, the transaction does not result in a re-contribution credit.

Estate planning

Upon death, your TFSA will fall into your estate to be distributed among your estate beneficiaries. Alternatively, similar to other registered plans, you may designate one or more beneficiaries on your TFSA contract. (Note for Quebec residents that the law does not allow beneficiary designations on plans in that province.)

Money paid out through a TFSA beneficiary designation is tax-free to recipients, but the money is no longer in the form of a TFSA (except for a spouse/CLP, as discussed below). Those beneficiaries may use that money for whatever purpose they wish, including contributing to their own TFSAs to the extent of their available room.

Planning for spouse/common-law partner

There are additional options and benefits if you wish to leave your TFSA to your spouse/CLP. You can name him/her as “successor holder” of the TFSA upon your death, which can be recorded on the TFSA contract or be stated in your Will. This applies to the entire plan, and therefore cannot be mixed with a beneficiary designation. The plan will then continue on with your spouse/CLP as the new annuitant (the owner) and, as with a transfer on separation, his/her existing contribution room is unaffected.

The same result can be achieved if your spouse/CLP is named as a designated beneficiary on the TFSA contract (sole or along with others) or is a beneficiary of your estate, though more steps are involved (ie., joint tax elections with the estate). As well, if the TFSA flows through the estate then probate fee/tax may apply to the value of the plan in some provinces. Even so, in more complex estates such as second marriages or mixed families, it may be necessary to use one of these other options where contingencies need to be built into the estate planning.

Whatever option may be chosen, it is important to understand that unused TFSA room cannot be transferred to anyone, even a spouse/CLP. In effect, it dies with the person. That should be considered by a couple in deciding how to draw down their savings, especially in more advanced years or when managing with a terminal medical condition.