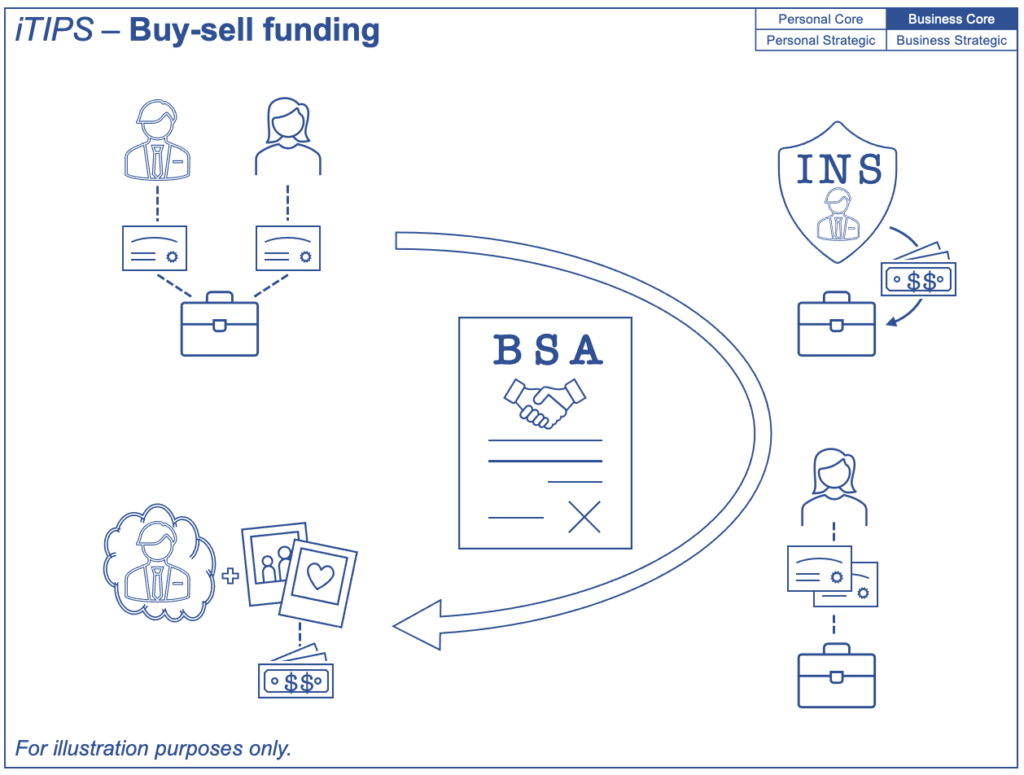

For an incubating business on the path toward profitability, owner interactions may be informal and dynamic. Then as things mature, focus shifts to sustainability and eventually succession. This is when more structure is needed, ideally anchored by a Binding Shareholders’ Agreement (BSA) that aligns everyone as managers, and guides them as owners. Beyond operations, the BSA can address the sticky matter of how they may part ways, sometimes called the four D’s: Departure, Disagreement, Disability and Death.

Of these, an owner’s death can be the greatest disruptor, often exacerbated when commercial interests are interwoven with family connections. A surviving spouse and family will be looking for a buy-out, but the other owners may have the bulk of their wealth tied up in the business. So, while a BSA can lay out the ground rules to resolve now-conflicting legal positions, it can’t assure that there are sufficient dollars (in the right hands) for everyone to fulfill their part.

Though not tax-deductible, insurance premiums paid by a corporation come out of ‘pre-dividend’ dollars. Not only does this cost less than paying personally, but the tax-free proceeds to the corporation opens the way for tax-free dividends to fund the share buyout process. Guided by the BSA, access to the lifetime capital gains exemption (LCGE) can be optimized for both the deceased and continuing owners. For each, this can eliminate tax on up to about $1 million of capital gains on small business shares.

PERSONAL insurance ownership may appeal to very small businesses, as it is the simplest structure:

♦ Criss-cross method – Shareholders own policies on each other directly, or through a trust.

CORPORATE ownership allows for more complexity:

♦ Promissory note method – This is preferred when the deceased’s full LCGE can be used.

♦ Corporate redemption method – Where no LCGE is available, this is the fallback route.

♦ Hybrid method – This is most appropriate when some LCGE has been used, but more remains.