Marshaling finances for residential ownership

For many of us, the largest financial transaction we will ever undertake is the purchase of a home. Fortunately, there are several public support programs and tax provisions available to provide financial relief for homeowners—and particularly first-time homebuyers. The most recent addition is the First Home Savings Account (FHSA), which became available for contributions by first-home buyers in 2023.

This article provides a summary of the main provisions aimed at assisting the initial purchase of a home, as well as measures that reduce the cost of renovations designed to make a property safer for the elderly and for those with disabilities.

A brief explanation is provided for each item, with hyperlinks to official government sources in an appendix on the last page, for readers who wish to look deeper into relevant topics.

Resources from Canada Mortgage and Housing Corporation 1

The Canada Mortgage and Housing Corporation (CMHC) is Canada’s national housing agency. Its central purpose is to make housing affordable for everyone in Canada. It has a wealth of resources available to help consumers and their professional advisors, including “Homebuying Step by Step: Your guide to buying a home in Canada” and a companion workbook “Homebuying Step by Step: Workbook and Checklists.”

Mortgage borrowing

A mortgage is a loan to help someone purchase a residence or home. The size of a mortgage is often significantly larger than the amount that new homeowners contribute toward the purchase price. Mortgage repayments are usually made at weekly or monthly intervals, with each payment being a combination of principal reduction and interest charge. Being so large, a mortgage will commonly up to two decades or longer to pay off.

Mortgage loan insurance 2

If the amount advanced on a mortgage is more than 80% of the property value, the lender must obtain loan insurance from the CMHC. The CMHC insurance premium ranges from 2.8% to 4% of the loan, which in turn depends on the size of the buyer/borrower’s down payment toward the purchase price. Though paid by the lender, typically the premium cost is passed through to the borrower.

30-year mortgages for qualified buyers 3

Commonly, mortgages are amortized for up to 25 years. As of August 2024, first-time buyers of newly constructed homes may be elgible for mortgages up to 30 years amortization. To be a first-time buyer, a borrower cannot have purchased a home before, or have occupied a home as a principal place of residence that either they themselves or their current spouse or common-law partner owned. Qualification may be extended to those who have recently experienced the breakdown of a marriage or common-law partnership. This measure will only apply to high-ratio mortgages where the loan amount exceeds 80% of the property value.

Mortgage stress test 4

Banks are regulated by the federal Office of the Superintendent of Financial Institutions (OSFI). As a margin of safety against negative financial shocks, OSFI requires federally regulated financial institutions to test whether borrowers will be able to handle higher interest rates if personal or economic conditions change. As last confirmed by OSFI in December 2022, a borrower must be able to service a mortgage interest rate at the greater of the mortgage contract rate plus 2%, or 5.25%. Note that the OSFI stress test does not apply to credit unions that are provincially regulated.

Assembling the down payment

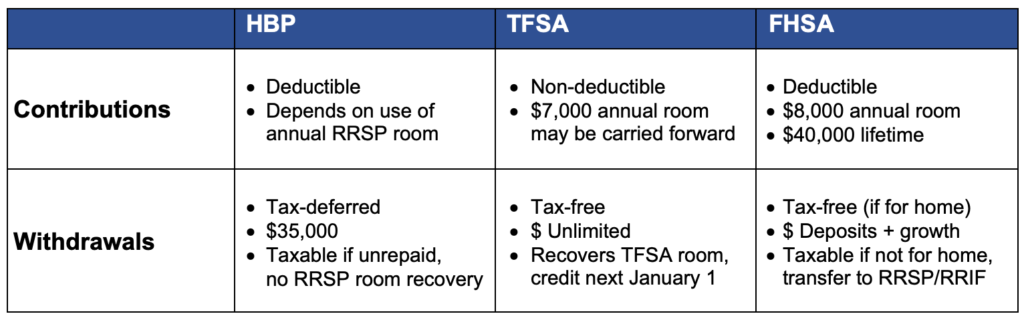

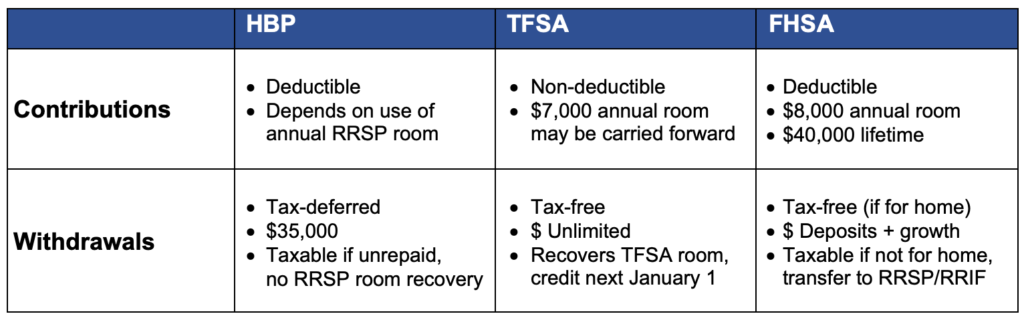

As compared to mortgage money that is borrowed from a lender, a down payment is the amount of the purchase price that comes from the buyers’ own resources. Buyers may accumulate savings in many ways, with three main programs currently available to provide tax-assisted support in building their down payment. All these programs may be used on the same property purchase.

HBP – Home Buyers’ Plan 5

A person with working income is entitled to make tax-deductible contributions into a Registered Retirement Savings Plan (RRSP). Though primarily intended for retirement, RRSP money may be accessible earlier for the purchase of a home. Since 1992, the HBP rules have allowed first-time home buyers to make non-taxable RRSP withdrawals. The current maximum withdrawal is $35,000 per person. That amount must be returned to RRSPs in annual, non-deductible repayments over the 15 years following the purchase, and otherwise will be taxable if not repaid.

TFSA – Tax-Free Savings Account 6

Introduced in 2009, the TFSA is a flexible plan that can be used for any savings purpose over a person’s lifetime. Every Canadian over age 18 gets an allotment of annual room—currently $7,000 in 2024—with unused room carried forward to be used in future years. Contributions are not deductible, but then there is no tax on income and growth within the plan, and withdrawals are tax-free. The total of all withdrawals in a year is credited toward more room for re-contribution from the next January 1.

FHSA – First Home Savings Account 7

Like a RRSP, FHSA contributions are tax-deductible, and income and growth within an FHSA are not taxable. Then, similar to a TFSA, withdrawals are non-taxable, though only if applied to the purchase of a first home. The maximum annual contribution amount is $8,000, with a lifetime maximum of $40,000. If not used to purchase a home within 15 years, or if the individual reaches age 70 years, all FHSAs must be closed. Tax will apply on withdrawals for any purpose other than a home purchase, but this can be deferred by transferring into a RRSP or Registered Retirement Income Fund (RRIF), without requiring or affecting the individual’s RRSP contribution room.

FTHBI – First-Time Home Buyer Incentive 8 *closed to new applications*

The FTHBI was launched in 2019, accepting applications up to March, 2024. The CMHC will continue to oversee all approved mortgages for their duration in accordance with the terms of the program.

Under the program, the CMHC provided 5% or 10% of a home purchase price through a shared equity mortgage. Buyers were required to qualify for mortgage insurance, with total income and borrowing within certain thresholds. Generally, the full amount must be repaid no later than 25 years or on sale but may be repaid at any time without penalty. The CMHC share of appreciation is capped at 8% per year.

Home buyers’ amount/credit 9

Also known as the first-time home buyers’ tax credit (HBTC), this is available as a one-time tax reduction for first-time homebuyers. It is calculated based on a $10,000 amount, making it worth $1,500 in reduced tax that can be claimed by one person or split with a spouse/common law partner. If the homebuyer claims the Disability Tax Credit (DTC) and the new home provides greater accessibility or accommodation for the disability, the claimants do not have to be first-time buyers.

GST/HST new housing rebate 10

The new housing rebate may reduce the GST/HST when purchasing from a GST/HST registrant builder, on an owner-built new home, or on a substantial renovation of at least 90% of a property. For owner-built and renovations, the rebate does not apply to the owner’s personal labour. The value of the rebate is up to $6,300 of the federal portion of GST/HST, and may apply to some of the provincial portion, depending on province.

Moving and renovation breaks

Moving expenses 11

Moving expenses may be deductible if a person must move 40km or more to be closer to work, to run a business, or to pursue full-time post-secondary education. Eligible expenses include vehicle and meal expenses during travel, property transportation, temporary lodging until new accommodation is available, costs of selling an old home (including real estate commission), and costs of acquiring a new home.

HATC – Home Accessibility Tax Credit 12

This can be claimed for someone age 65 years or over, or over 18 and eligible for the DTC. It is worth as much as $3,000 based on spending up to $20,000 to make a dwelling more accessible for that person or to reduce risk of harm for that person living there. The amount is available annually and may be applied to a project extending over multiple years, or to different projects each year. It may be claimed by that person or by an eligible caregiver.

MGHRTC – Multigenerational home renovation tax credit 13

Like the HATC, this credit can be claimed for someone age 65 years or over, or over 18 and eligible for the DTC. It is worth as much as $7,500 based on spending up to $50,000 to create a self-contained secondary unit attached to another residence. Whereas the HATC is a non-refundable credit that can reduce tax payable, this is a refundable tax credit that can be claimed and paid even if the person doesn’t owe tax. It may be claimed by the person being accommodated, or by the family relation who owns the property.

Canada Greener Homes Initiative 14

This program provides incentives to homeowners to make their homes more energy efficient. There are grants from $125 to $5,000 on retrofits, with up to $600 reimbursed for the cost of pre- and post-retrofit evaluations. For major projects, interest-free loans up to $40,000 may be obtained, with repayment terms of 10 years.

PRE – Principal residence exemption 15

Generally, tax applies to the increase in the value of property, levied on half of the capital gain in the year there is a disposition. The PRE exempts the capital gain on a principal residence from being taxed. The gain must still be reported on the income tax return for the year of sale/disposition, but then the PRE protects against it being taxed. The PRE is shared between spouse/Common law partners.

Links to official government sources

-

- CMHC – https://www.cmhc-schl.gc.ca/en/consumers/home-buying

- Mortgage loan insurance – https://www.cmhc-schl.gc.ca/en/consumers/home-buying/mortgage-loan-insurance-for-consumers/what-is-mortgage-loan-insurance

- 30-year mortgages for qualified buyers https://www.canada.ca/en/department-finance/news/2024/06/30-year-mortgages-for-first-time-buyers-of-new-builds.html

- Mortgage stress test – https://www.osfi-bsif.gc.ca/Eng/osfi-bsif/med/Pages/mqr20221215-nr.aspx

- HBP – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan.html

- TFSA – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account.html

- FHSA – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html

- FTHBI – https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive

- Home buyers’ amount – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31270-home-buyers-amount.html

- GST/HST rebate – https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4028/gst-hst-new-housing-rebate.html

- Moving expenses – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-21900-moving-expenses.html

- HATC – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31285-home-accessibility-expenses.html

- MGHRTC – https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/federal-government-budgets/budget-2022-plan-grow-economy-make-life-more-affordable/multigenerational-home-renovation-tax-credit.html

- Canada Greener Homes Initiative – https://natural-resources.canada.ca/energy-efficiency/homes/canada-greener-homes-initiative/canada-greener-homes-grant/canada-greener-homes-grant/23441

- PRE – https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/principal-residence-other-real-estate/sale-your-principal-residence.html